Traditional retail financing often comes down to a binary decision: you’re approved or you’re not. In other words, the offer is static, the terms are fixed, and the decision rarely takes the shopper’s context into account. For retailers, this inflexibility has meant lost sales and missed opportunities to build stronger customer relationships.

Fortunately, this is changing. Modern BNPL platforms—and new forms of embedded consumer financing—have emerged to bring flexibility, personalization, and smarter decisioning to the forefront. Younger shoppers are driving much of this shift, and our Gen Z & Millennials BNPL 2025 analysis highlights how personalization has become a baseline expectation for these demographics.

From Static Offers to Personalized Finance

In 2025, pay-over-time and POS financing gateways are fundamentally shifting this paradigm. Retailers are no longer limited to rigid financing options. Instead, they’re using multi-lender routing and offer engines to deliver financing that feels as contextual as product recommendations.

These personalization dynamics become even more crucial during peak retail events, as outlined in our Black Friday 2025 BNPL analysis, where tailored financing flows help turn seasonal traffic spikes into higher approval rates and real revenue gains.

➤ Single-lender BNPL: one provider underwrites and prices; simpler, but less coverage across the credit spectrum (eg Affirm, Klarna, Afterpay).

➤ BNPL platform/gateway (multi-lender): One UX; routes a single application across a network of lenders and returns best-fit offer(s). Merchants get lender-level analytics.

Why BNPL Platforms Function as Personalization Engines

Today’s consumer-financing platforms do far more than delay payment. They’ve evolved into personalization engines that shape the payment experience across multiple signals.

Advanced Financing Personalization Includes:

Behavioral data analysis

Identifies spend patterns and purchase intent.

Smart underwriting

Assesses risk beyond credit scores with alternative data.

Real-time scoring

Updates eligibility as context changes (device, cart, history).

Dynamic offer generation

Adaptive financing

per cart & buyer.

This evolution transforms Buy Now Pay Later into a strategic tool for contextual checkout experiences.

Matching Engines and Behavioral Targeting

Under the hood, personalization comes from two engines working together: a scoring layer that decides which products/terms to show, and a routing layer that sends each application to the best-fit lender.

How Advanced Scoring Drives Personalization

Modern BNPL gateways personalize with data that’s close to the transaction—then route to best-fit lenders.

- Cart & category signals (ticket size, product type) shape which payment products to show (e.g., Pay-in-4 vs monthly installments) 1.

- Application & device signals (identity, soft credit checks, fraud screening) inform eligibility in real time. 2

- Provider history (past usage with the Buy Now Pay Later provider) can streamline approval and tailor terms.

- Multi-lender routing matches each application to prime/near-prime/subprime partners and can present multiple offers side-by-side.

This multi-signal approach lets BNPL platforms adapt the product mix and terms shown. For example, a first-time visitor may see a short-term 0% plan, while a known reliable payer may qualify for a 6–12-month installment option—without reapplying. Eligibility comes from the provider’s underwriting; the gateway handles routing to best-fit lenders.

Note: Using deep retailer CRM (e.g., purchase frequency with the merchant or cart-abandon history) in credit decisioning is not default; it requires explicit integrations, disclosures/consent, and compliance review.

Machine Learning Enhances Offer Relevance

Some gateways use model tuning to learn which products/terms convert by category and ticket size, then adjust defaults accordingly.

BNPL Platforms as Experience Enablers

“Integrating Buy Now Pay Later options on product pages or early in the buyer journey is proven to improve conversion and reduce cart abandonment—particularly for higher-value or considered purchases.”, notes Stéphane Touboul, founder of WeGetFinancing.

Financing doesn’t just happen at checkout anymore. By integrating embedded consumer credit into both the checkout flow and the CRM stack, merchants can reshape the entire journey.

Early Funnel Integration

Forward-thinking retailers are moving financing options earlier in the customer journey. By presenting personalized Buy Now Pay Later offers at the product page or even during browsing, these merchants reduce friction and increase purchase intent.

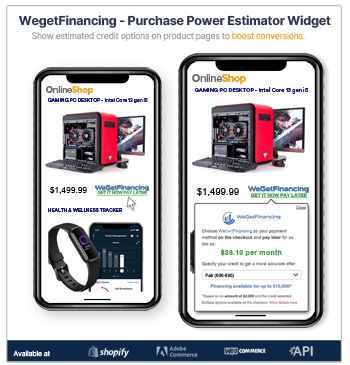

Widget Highlight: Purchase Power Estimator — Use What Works

For anyone who has shopped in a furniture, appliance, or computer store, credit options are often displayed right next to the price tag. The reason is simple: when customers understand their financing possibilities upfront, it shapes their purchase decision. If financing is only introduced at the last step—checkout—it’s often too late.

That’s exactly why WeGetFinancing developed the Purchase Power Estimator. This easy-to-deploy widget lets customers pre-check their estimated payments by inputting their credit profile directly on product pages. The result? Greater transparency, stronger trust, and a smoother path to conversion. By surfacing financing options early, merchants not only build confidence but also drive more sales.

Dynamic Offer Presentation

The integration of BNPL platforms with broader merchandising systems creates powerful opportunities for dynamic offer presentation. It’s not just about saying ‘yes or no’—it’s about showing a financing plan that matches each buyer’s unique situation.

Modern BNPL platforms enable contextual financing offers that adjust based on:

- Cart composition and total value

- Customer segment and history

- Seasonal promotions and inventory conditions — see our Black Friday BNPL playbook for peak-season tactics.

- Device type and shopping context

This approach isn’t limited to payment processing. Buy Now Pay Later personalization drives smoother user experiences, builds trust through transparency, and deepens loyalty through appropriate financing terms.

Purchase Context Matters (Ticket Size & Category)

Terms and presentation commonly vary by ticket size and category. For higher-value or considered purchases, major BNPLs support longer terms (e.g., 6–36 months), while smaller baskets often use short, interest-free installments.

Product-aware adaptations also ensure that financing is not only accessible, but also aligned with buyer expectations and purchasing behavior.

BNPL Personalization in Practice

The theoretical benefits of personalized Buy Now Pay Later solutions become clear through practical application. Rather than invent hypothetical case studies, let’s ground the strategy in real-life examples and validated patterns.

- PC Gaming: Origin PC offers flexible ¨PC financing through WeGetFinancing, helping gamers split $2,000+ purchases into 6–36 month plans based on credit.

- Furniture: Many home retailers now surface extended financing early on PDPs, matched by category and price. See how STORIS-powered POS financing is changing the game in-store.

- eCommerce General: According to the Worldpay Global Payments Report, merchants who implement segmented BNPL offers see conversion improvements of 15–30% on average

Why BNPL Gateways Beat Single-Lender Models for Personalization

Single-lender financing models inherently limit personalization capabilities. However, multi-lender Buy Now Pay Later platforms dramatically expand the personalization potential.

Gateway advantages at a glance

Deeper Financing Insights (Not Just a Payment Button)

Beyond conversion, gateways surface financing performance: approval rates, take-rate by term, and outcomes by cart value or category. Multi-lender setups add lender-level reporting so you can tune routing and promotions.

Note: Underwriting and real-time decisions typically rely on application/transaction inputs and provider models; ingesting a merchant’s CRM behavior requires custom integrations and isn’t default.

BNPL Benchmarks to Keep in Mind

+20–30% conversion after adding BNPL (Obvy / BNP Paribas, 2023–24).

+30–50% AOV with flexible installments (HubSpot, 2024).

45% repeat purchase among BNPL users (Allianz Trade, 2024).

Now, to go beyond baseline, make sure your BNPL platform can do the following.

BNPL Platforms: Capability Checklist

Routes each application across a multi-lender network to maximize approvals while keeping UX unified.

Prime, near-prime, and subprime supported so more customers see an eligible plan.

Show multiple financing options at once (e.g., Pay-in-4 and monthly) so shoppers choose— no waterfall retries.

Provide tools that inform shoppers of their purchasing power before checkout (e.g., PDP payment estimator / pre-check).

Track approvals, take-rate, and performance by lender/term to tune routing and promotions.

Final Word: Personalization as a Competitive Edge

“The retailers seeing the greatest ROI from Buy Now Pay Later aren’t just offering a payment option,” says Stephane Touboul, founder of WeGetFinancing. “They’re delivering a personalized financial experience that feels as tailored as their product recommendations. That’s the new benchmark for success.”

Static credit is easy to implement—but personalization wins. BNPL platforms act like a routing and offer engine, aligning lenders and terms to each cart and customer. Start where it counts: show financing earlier, route across multiple lenders, and present options side-by-side. Then measure what moves completion—keep that, cut the rest. In short? Payment is no longer an afterthought—it’s a competitive edge.

Ready to upgrade to modern financing?

Let WeGetFinancing show you how intelligent financing can work for your customer experience.

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.

Sources :

- Adaptative checkout, Businesshub, Affirm.com ↩︎

- Consumer Use of Buy Now, Pay Later and Other Unsecured Debt Consumerfinance.gov ↩︎