Approval gaps, rejections, and revenue at risk.

Is Your BNPL Setup Limiting Your Business Growth?

This diagnostic focuses on BNPL and consumer financing performance —

approval rates, rejections, and how customers are routed at checkout.

It helps merchants assess whether their current financing setup may be limiting growth, before making any technology decisions.

If any of these situations sound familiar, your growth may be capped by financing.

Traffic can increase.

Products can perform.

Purchase intent can be strong.

Yet results still stall — whether at checkout, on higher-ticket items, or later in the decision process.

Not because of demand —

but because financing decisions fail silently, without visibility.

Take 60 seconds to see if this applies to your business.

RUN OUR SHORT FINANCING PERFORMANCE CHECK

Focused on approvals, rejections, and financing visibility

Self-Identification Checklist

Does this sound like your current situation?

Check all that apply:

If you checked more than one box, this is not a marketing problem.

It’s a financing performance issue. You can quickly verify this using our Financing Performance Check.

A short, exploratory diagnostic focused on financing visibility.

Why this happens

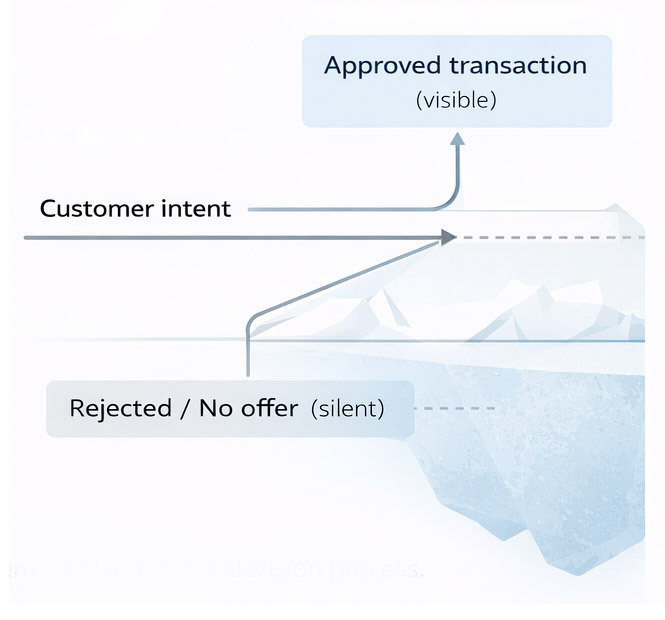

Most merchants think financing is binary:

You either offer BNPL — or you don’t.

In reality, financing performance depends on how customers are matched to approval paths.

As customer profiles diversify — higher ticket sizes, new generations, omnichannel journeys — a single financing logic rarely fits everyone.

The result:

- Good customers rejected

- Strong purchase intent blocked

- Revenue that never reaches checkout

And most of it goes completely unseen.

What we see repeatedly

Across industries and ticket sizes, the same patterns emerge:

- Approval rates drop as demand grows

- Financing works well for some profiles — and fails for others

- Growth plateaus even though interest is there

- Teams optimize marketing, UX, and pricing — but not financing logic

This is not a failure of BNPL.

It’s a structural mismatch between customers and financing paths

So how exposed is your business?

Instead of guessing, you can quickly assess whether financing is limiting your performance.

This short diagnostic helps identify:

- Where approvals may break down

- Revenue at risk

- How well your current setup supports growth

Prefer a more personal or qualitative perspective?

You can also connect directly with a financing expert.

A short, free conversation focused on understanding your current situation.

WeGetFinancing helps merchants reduce financing rejections by matching customers to the right approval paths — without disrupting their existing stack.