E-commerce has experienced remarkable growth in recent years, transforming how consumers shop and how businesses operate. In the United States alone, e-commerce sales reached $579.45 billion in the first half of 2024, accounting for 15.9% of all retail sales. Projections indicate that by the end of 2024, sales will surpass $1.22 trillion (1), with a compound annual growth rate (CAGR) of 8.99% through 2029. Globally, e-commerce and best e-commerce platforms represents over 19% of total retail sales (2), with expectations to cover nearly a quarter of global retail sales by 2027.

But Why?

A significant driver in this e-commerce expansion is the evolution of consumer financing options like Buy Now, Pay Later and Point Of Sale (POS) solutions. Originating as early as the 19th century in various forms, BNPL has recently solidified its place within the modern retail ecosystem, particularly with the rise of fintech innovations. These financing tools have empowered consumers to purchase high-value items more easily and are projected to grow, with POS lending expected to increase by over 40% annually through 2030. As society moves forward, these developments indicate that leveraging robust e-commerce platforms and integrating flexible financing solutions will be critical for businesses aiming to capture and retain their spot in the market.

E-commerce Platforms: The Rise of Plug And Play Solution For E-Merchants

E-commerce platforms like Wix, WordPress and Shopify have revolutionized how businesses operate online, with over 26.6M stores globally as of 2024. Once a distant dream for tech-savvy entrepreneurs in the 1960s with the rise of Electronic Data Interchange, e-commerce has since become ubiquitous. Thanks to game-changers like Shopify and WordPress in the 2010s, setting up an online store is now as straightforward as clicking a button, even for those without a technical background. The COVID-19 pandemic also accelerated the boom, pushing businesses and consumers alike toward digital commerce solutions. Overall, these platforms have democratized commerce, making it accessible for anyone with a product and a vision to reach a global audience.

Today, e-commerce platforms have evolved into leveraging plug-and-play solutions, providing e-merchants with intuitive tools to launch and manage their online stores efficiently. These user-friendly platforms come packed with robust features such as point-of-sale financing and Buy Now, Pay Later options, making it easier for businesses to offer flexible payment solutions that appeal to modern consumers.

The integration of these commerce platforms simplifies the setup process, streamlines checkout processes, and increases sales by making higher-end products more attainable. Looking ahead, as the demand for agile and adaptable commerce platforms grows, it’s clear that these plug-and-play solutions will play a key role in the future of eCommerce.

Timeline – Quick View

The Early Days (1960s-1980s)

- 1960s: Introduction of Electronic Data Interchange (EDI) enabling electronic transfer of business documents.

- 1982: Launch of Boston Computer Exchange, one of the first eCommerce companies.

- 1980s: France’s Minitel allowed users to access various online services, a precursor to the modern internet.

The Internet Era (1990s-2000s)

- 1990: Tim Berners-Lee introduced the Worldwide Web, setting the stage for online shopping.

- 1995: Foundation of Amazon, revolutionizing eCommerce with features like customer reviews.

- 1995: Introduction of Secure Socket Layers (SSL) for secure online transactions.

The Social Media and Mobile Commerce Boom (2010-Present)

- 2010s: Social media platforms like Facebook and Instagram drive eCommerce growth.

- 2014: Mobile commerce rises with platforms adding “buy buttons” to facilitate easy purchasing.

- 2020: COVID-19 accelerates eCommerce adoption, with a 77% transaction increase.Buy Now, Pay Later (BNPL) solutions simultaneously take off with traction.

- 2024 and Beyond: Continued globalization of plug-and-play and mobile commerce reshape consumer interactions, with a focus on secure, personalized experiences.

Top E-commerce Platforms On The Marketplace

When it comes to top e-commerce platforms in 2024, several names stand out:

Shopify: Intuitive Commerce for Fast-Growing Brands

Shopify is popular among small and medium-sized e-commerce brands due to its user-friendly interface and range of features. It holds a significant market share of 17.56% (3). Shopify offers various BNPL solutions like Afterpay, Klarna and WeGetFinancing, allowing customers flexible credit options. However, its transaction fees can be a downside for some.

WooCommerce: Total Flexibility for WordPress Users

WooCommerce is a powerful choice for those already using WordPress, offering unparalleled customization and flexibility. While it’s free to start, costs can increase with additional plugins and hosting needs. WooCommerce has a strong market presence, around 66.45%, due to its integration capabilities and for supporting BNPL through integrations like Klarna, WeGetFinancing and PayPal Credit. The downside is its reliance on WordPress, which may require more setup for non-technical users.

Adobe Commerce: Enterprise-Level Power, Built to Scale

Formerly Magento, Adobe Commerce is perfect for larger businesses with complex needs. To date, it holds a 2.27% market share and offers dynamic features and customizations. This is along with offering BNPL options like WeGetFinancing, Zip and Splitit. Again, this is ideal for larger businesses; its complexity might be overwhelming for smaller brands.

BigCommerce: Scalable E-commerce with Seamless Integrations

Capturing a 1% market share, BigCommerce stands out with its scalability and seamless integrations. It is known for its multi-channel selling features that support growing businesses. It also partners with BNPL providers like WeGetFinancing, Afterpay and PayPal Credit. The trade-off is that it can be pricier than other platforms. In addition, the design options can be limited compared to competitors.

Prestashop: Open-Source Freedom for Developers and Tinkerers

Great for tech-savvy users, Prestashop is a highly customizable platform without monthly fees. Its open-source nature allows endless possibilities, but again, may require more technical knowledge. Its .28% market share reflects a niche yet loyal user base and is valuable for integration with BNPL providers like Klarna.

SquareSpace: Stunning Looks, Simple Checkout—with Limits

With a 45.23% market share, SquareSpace is favored for its stunning design templates. It is suitable for visually driven stores and, yes, offers BNPL options such as Afterpay. The limitation is that it might not be as feature-rich for larger eCommerce needs.

When e-commerce Platforms Meet BNPL Options

“EMARKETER forecasts 93.3M US consumers will use BNPL services by the end of 2024.“

Integrating Buy Now Pay Later options into e-commerce platforms has transformed how consumers shop – in a good way. Originating as a flexible payment solution, BNPL allows customers to spread the cost of their purchases over time, making it an attractive alternative to traditional credit cards. This payment method has gained traction across the United States, with 14% of Americans using BNPL in 2023, up from 12% in 2022. The appeal? The simplicity and trust it offers. In fact, 62% of consumers (4) express greater confidence in BNPL providers than in credit card companies.

EMARKETER forecasts 93.3M US consumers will use Buy Now, Pay Later services by the end of 2024. In short, adopting BNPL by eCommerce platforms is not just a pass by trend; it’s a response to ever-changing consumer preferences and the growing demand for financial flexibility. This shift is especially highlighted among younger generations, with 58% of Gen Z and 64% of millennial respondents using BNPL at least once. For e-commerce businesses, having BNPL options, especially multi-lender ones like WeGetFinancing, equates to higher brand loyalty, boosted sales, and ultimately, a secured competitive edge.

What BNPL Solutions Suits Best My Business?

In the dynamic US financing market, picking the right BNPL solution is crucial for businesses aiming to enhance customer experience and drive sales. Here are some traditional contenders:

Klarna

Klarna has quickly become a favorite among retailers, known for its innovative approach to flexible payment options. It offers tailored payment plans that accommodate a variety of customer preferences, making it a versatile choice for businesses looking to give their customers more control over their purchases.

PayPal

PayPal continues to be a benchmark for ease of use and reliability in the digital payment landscape. A globally trusted brand, PayPal ensures secure transactions that instill confidence in consumers and merchants. Its comprehensive payment solutions support various business models, from small startups to large enterprises, allowing them to expand their reach while maintaining operational efficiency.

Affirm

Affirm distinguishes itself with transparent terms and straightforward payment options, making it ideal for businesses prioritizing clear-cut financial solutions. It simplifies the purchasing process by allowing customers to understand their payment plans clearly, thus fostering trust and reducing cart abandonment. Affirm’s no-late fee policy and the absence of hidden charges resonate well with consumers who value straightforwardness.

WeGetFinancing

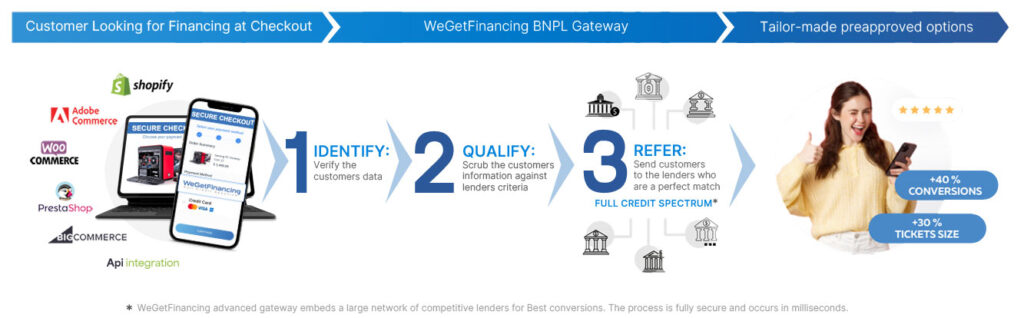

WeGetFinancing leads the buy now, pay later market, offering consumers instant financing from various sources while minimizing credit score impacts. Their unique strategy increases average order values, boosts customer loyalty, and ultimately enhances profitability. This solution is especially advantageous for high-ticket sales, as WeGetFinancing provides a large range of financing options tailored to different customer needs and purchase sizes.

While Klarna, PayPal, and Affirm have established themselves with straightforward split-payment options suitable for smaller purchases, WeGetFinancing stands out with its multi-lender predictive financing model. Unlike the single-lender approach where consumers are stuck with limited options and potential credit score hits, WeGetFinancing offers a multi-lender waterfall financing approach that can be easily integrated in platforms like Shopify, WooCommerce, BigCommerce, and Magento. This means:

- Multiple Lender Access – Consumers can access various lending sources instantly without multiple credit checks, preserving their credit scores.

- Increased Flexibility – Businesses can cater to high-ticket sales, improving customer loyalty and boosting their bottom line.

- Higher Approval Rates – With multiple lenders, approval rates increase, providing more opportunities for consumers and merchants.

In summary, single-lender BNPL options have limitations like restricted terms and potential credit damage. Multi-lender solutions like WeGetFinancing bypass this issue by providing a safer and more flexible alternative that enhances point-of-sale financing options and consumer experiences across commerce platforms.

Activation of BNPL Solutions At E-commerce Platform

Activating a BNPL solution on your e-commerce platform is generally an easy process that doesn’t require extensive technical skills. For the most current plugins and compatibility list, see our WeGetFinancing BNPL integration overview.

The ease of applying it largely depends on the commerce platform you’re using, as most provide dedicated plugins for a seamless setup. For each platform, simply locate the relevant Buy Now, Pay Later plugin in their marketplace or dedicated plugin section.

These details are typically found on the provider’s website. For example, Shopify users would head to the Shopify App Store and search for BNPL solutions. In addition, WooCommerce users can locate their BNPL options within the WordPress plugin directory.

Single Lender Vs. Multiple Lenders On E-commerce Platforms

“One of the main challenges of using a single lender is the reliance on one financial institution to approve all customer transactions.”

Single lenders have become popular on commerce platforms by offering Buy now, pay later options. However, these solutions often fall short of addressing the diverse financing needs of all customers, particularly across different demographics and credit scores. This limitation can lead to consumer confusion, and that can increase the likelihood of purchase abandonment.

One of the main challenges of using a single lender is the reliance on one financial institution to approve all customer transactions. This can be risky, especially if the lender applies strict credit scoring models or only specializes in certain retail industries. Furthermore, larger lenders may tighten their credit policies in times of economic uncertainty, resulting in fewer accepted applications. Unfortunately, many single lenders don’t disclose the number of applicants they decline due to factors like low to average credit scores, existing credit with the institution, or being a first-time buyer.

Overall, when a customer is declined by a single lender at checkout, they’re unlikely to attempt another complex verification process with a different lender. The e-commerce golden rule warns against adding obstacles during checkout, which risks losing customers. In an era dominated by impulse buying, a decline can lead to frustration and negative feelings toward your brand.

The solution?

Opting for multiple lender services can accommodate consumers’ unique financial requirements. Companies like WeGetFinancing enable businesses to offer a broader range of financing options, which can enhance conversion rates. By presenting a unified, multi-lender solution, online businesses can streamline the A to B checkout process and create a seamless, inclusive shopping experience. In summary, offering multiple lenders at the point of sale can significantly improve customer satisfaction and boost sales. To date, it’s the best combination to offer a smart Buy Now Pay Later solution and advantaged consumer financing.

Financing The Future With WeGetFinancing

The bottom line? Point of sale financing and Buy Now, Pay Later solutions have become a key component of the shopping experience now and in the future. Offering consumers the flexibility to finance their purchases instead of paying upfront alleviates financial strain significantly. With the Buy Now, Pay Later market continuing its upward trajectory, WeGetFinancing is at the forefront of this growth, providing a broad spectrum of financing options through a network of lenders and banks. With instant approvals for diverse credit profiles, WeGetFinancing BNPL gateway is working in tandem with both sides of the transaction, ensuring an effortless payment experience as the industry continues to evolve.

Visit WeGetFinancing today to learn more.

Sources & references

(1) sellerscommerce.com/blog

(2) bigcommerce.com/articles/ecommerce/

(3) All sources and numbers from this part comes from source 6sense.com ecommerce-platform

(4) Fool.com research