“If you stay on top of your budget and use BNPL thoughtfully, buying furniture doesn’t have to feel like a financial leap; it can feel like a well-planned step toward making your home your own.”

— Miami Herald, September 2025

Why are more Americans financing their sofas, beds, and dining tables instead of swiping a credit card? That sentence from the Miami Herald says it all: in 2025, BNPL has become a thoughtful, mainstream way to buy furniture — one that balances affordability, control, and convenience.

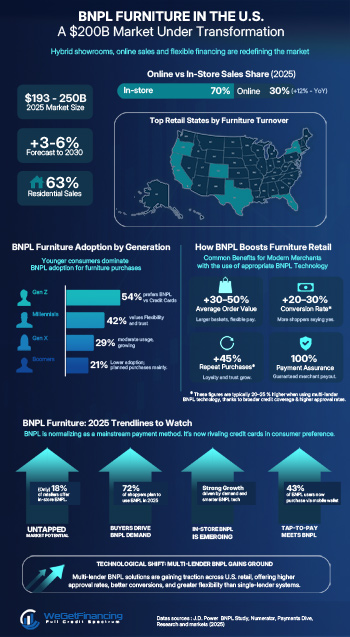

For retailers, this shift is equally significant. The BNPL furniture market is one to watch closely, with adoption rising across showrooms and online stores alike. Valued between $190 and $250 billion, U.S. furniture retail now stands at the crossroads of consumer demand, digital innovation, and new financing habits.

From Showroom to Smart Financing

Hybrid showrooms, mobile payments, and real-time credit approval are blending into a seamless shopping experience where flexibility drives purchase decisions.

As traditional credit models lose ground to transparent, short-term financing, BNPL is no longer a side option — it’s a strategic growth lever for retailers. This 2025 snapshot examines the figures, trends, and technologies transforming the industry — and why understanding BNPL’s evolution has become essential for every furniture merchant.

U.S. Furniture Market: Steady Growth Meets Digital Acceleration

According to Research and Markets (2025) and Statista data, the U.S. furniture market is valued between $193 and $250 billion, growing at a projected 3–6% CAGR through 2030, with residential sales accounting for roughly 63% of the total. E-commerce penetration is rapidly increasing, led by hybrid “showroom + online” retail models.

Consumers have embraced the convenience of digital browsing combined with in-store consultation. The pandemic years permanently shifted buying habits, with online furniture sales growing at double-digit rates and omnichannel retail now becoming the standard model.

This digital acceleration naturally complements the rise of BNPL—flexible, transparent, and seamlessly embedded into both e-commerce checkouts and in-store POS systems.

The Rise of BNPL in Furniture Retail

The furniture industry sits at the heart of BNPL adoption. As of 2025, furniture and home décor represent 26 – 42% of BNPL purchases, ranking third behind apparel and electronics.

Key demographic insights show a clear generational divide:

- Millennials (Gen Y) and Gen Z each show 42% adoption (J.D. Power’s 2025 U.S. BNPL Study and Numerator Insights)

- Women use BNPL slightly more than men (20% vs. 14%).

- Most users are urban, multicultural households earning under $60,000 annually, with a focus on managing cash flow and spreading payments for large purchases. (PaymentsDive, 2025)

While online BNPL remains dominant, in-store BNPL is the fastest-growing use case as consumers expect the same flexibility at the showroom checkout that they enjoy online. This reflects a major evolution: consumers now expect the same flexibility at the showroom checkout that they enjoy online.

Industry observers including J.D. Power and Pymnts.com have already pointed it out: BNPL is no longer an e-commerce experiment. It has matured into an established payment solution—and for modern furniture retail, it’s now an omnichannel standard.

Why Furniture Retailers Are Leaning on BNPL

The Business Impact

BNPL isn’t just a payment trend—it’s delivering measurable results for furniture retailers across the U.S.

Furniture retailers adopting BNPL can expect strong, measurable results:

- +20–30% higher conversion rates at checkout (multi-lender solutions usually claim up to 40%)

- +30–50% increase in average order value (AOV)

- +45% repeat purchases, showing improved customer retention when BNPL is fair and clearly marketed

For large-ticket items such as living-room sets, dining tables, and bedroom furniture, BNPL bridges the gap between aspiration and affordability—helping customers say yes sooner.

Note: Most publicly reported averages come from single-lender BNPL programs. Multi-lender solutions typically deliver higher acceptance rates and a wider credit spectrum by matching each shopper to the right financing source.

Furniture Retailer Benefits and Challenges

Understanding BNPL’s advantages and operational hurdles helps retailers build stronger, more flexible financing ecosystems.

| Benefits | Key Considerations |

|---|---|

| Higher sales and average order value | Integration with POS / ERP systems requires planning |

| Reduced fraud and chargeback risk1 | Clear communication to address consumer debt concerns |

| Improved customer satisfaction and loyalty | Compliance and clear upfront marketing required 2 |

| Immediate merchant payment (BNPL provider assumes risk) | Reconciliation with legacy finance tools can take fine-tuning |

Retailers also value the fact that BNPL providers assume credit risk and manage repayments, allowing stores to focus on sales rather than loan administration. Yet operational complexity—especially for furniture businesses using sophisticated ERP systems—can be a hurdle.

The Tech Backbone: ERP & POS Systems Driving Furniture Financing

Behind every successful furniture retailer lies a strong ERP backbone—managing everything from inventory and delivery scheduling to checkout and financing integration.

The ERP Landscape

The leading ERP and POS solutions in 2025 include STORIS, Shopify, Lightspeed, Square for Retail, and Microsoft Dynamics 365.

| ERP / POS | Best For | BNPL Integration | Key Advantages | Considerations |

|---|---|---|---|---|

| Mid- to large furniture chains | ✅ Native / via WeGetFinancing | Retail-specific, full POS & inventory control | Premium positioning |

| Omnichannel brands | ✅ Via apps | Seamless e-commerce integration | Add-on costs for advanced features |

| Multi-store retailers | ⚠️ Partial | Strong analytics + inventory | No native BNPL |

| Small to mid-size stores | ✅ Native | Simple setup, affordable | Limited scalability |

| Enterprise retailers | ✅ Custom | Scalable finance suite | Complex implementation |

Why STORIS Leads the Pack

While STORIS commands a premium positioning compared with lightweight POS platforms, the investment pays off through long-term scalability, automation depth, and native financing integration—making it the benchmark ERP for furniture retailers.

Nowadays, STORIS has become the gold standard for furniture retail management, serving top U.S. retailers like Arhaus, Mathis Home, and Haynes Furniture. Its integrated POS, customer management, and inventory modules were designed for large-ticket, complex sales — where customization, delivery scheduling, and financing intersect.

WeGetFinancing Fully Embedded into STORIS

“STORIS gives furniture retailers the operational power; WeGetFinancing gives them the financial flexibility,” says Stéphane Touboul, CEO of WeGetFinancing.

WeGetFinancing’s multi-lender gateway is now fully embedded inside STORIS, enabling associates to access a wide range of pre-approved financing offers in real time—directly within the checkout flow.

This multi-lender model improves approval rates and maximizes customer satisfaction by matching each shopper to the right financing source. For retailers, financing becomes an enabler rather than a bottleneck.

In-Store BNPL Furniture: From Pilot to Powerhouse

In-store BNPL has moved well beyond testing—it’s now a core growth driver for furniture retailers. The share of BNPL transactions taking place through physical POS continues to rise each year as consumers embrace flexible, transparent payment plans.

Flexible installments—often interest-free for six to 24 months—help shoppers upgrade quality without overextending budgets. For merchants, that means higher conversions and larger bundled sales across categories such as living-room, bedroom, and dining furniture.

The New Standard: Seamless Checkout

Retailers know that complex checkout flows kill conversions. Offering several isolated single-lender options often leads to friction: prime-score bias, duplicate forms, and abandoned carts. The market is shifting toward multi-lender BNPL gateways that deliver one application, instant decisions, and full-spectrum credit coverage.

As outlined in Not All BNPLs Are Created Equal, these solutions provide faster approvals, broader accessibility, and a more inclusive customer experience—the essentials of a modern furniture checkout.

Real-World BNPL Furniture Showcases

The success of BNPL in furniture is already visible through forward-thinking retailers:

- Modular Closets — helping customers design custom storage solutions with flexible financing.

- Quality Home — the first retailer to deploy WeGetFinancing’s BNPL solution through STORIS, offering instant in-store approvals powered by SensePass.

Together, these examples show how multi-lender financing drives higher satisfaction and operational simplicity for merchants.

BNPL Furniture Market Forecast: Toward 2030

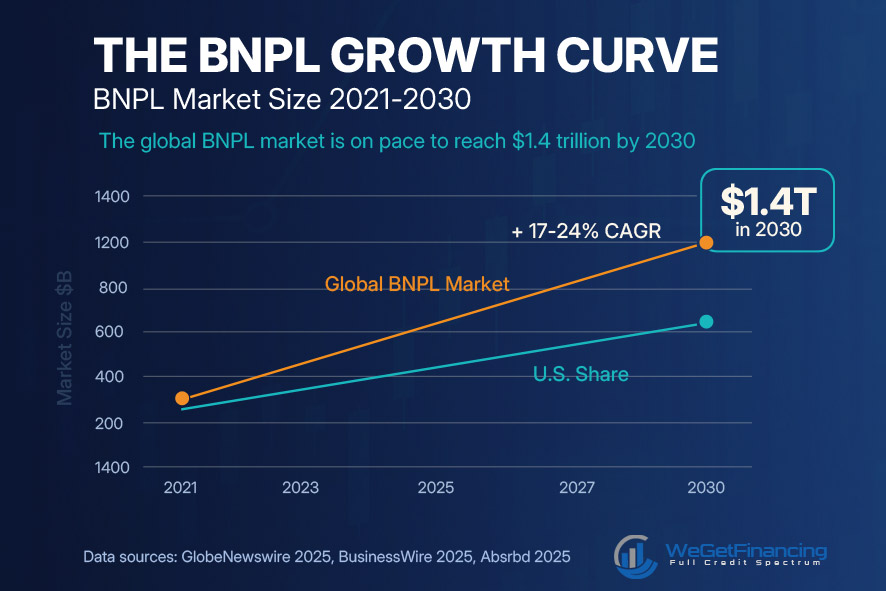

Looking ahead, the figures are quite impressive. The global BNPL market is projected to reach $1.4 trillion by 2030, with growth rates between 17% and 24% annually (GlobeNewswire, 2025). The U.S. remains a key driver, particularly in durable goods and high-value retail categories such as furniture and home décor.

As merchants migrate from single-lender setups to multi-lender BNPL gateways, approval rates and inclusivity are expected to rise sharply. BNPL will continue to complement—not replace—traditional credit, serving as a transparent, embedded, and accessible financing channel across retail ecosystems.

Key Takeaways for Furniture Retailers

Shoppers, especially Gen Z and Millennials, want financing options as frictionless as their checkout experience.

Showrooms can now replicate online financing journeys—boosting trust and order size.

ERP-native integrations ensure instant decisions and unified reporting.

Retailers that have already adopted such BNPL solutions confirm the trend: they expand credit coverage across shopper profiles, improving approval rates and overall customer experience.

Financing That Fits the Furniture Industry

As furniture retailers modernize, flexible financing has become a business driver, not just a payment option.

BNPL bridges the gap between affordability and aspiration—empowering customers to make confident, larger purchases. For merchants, it delivers higher sales, stronger loyalty, and a smoother in-store experience that rivals e-commerce convenience.

In 2025 and beyond, the real advantage lies not in offering BNPL, but in offering it better.

With platforms like STORIS and WeGetFinancing, retailers can transform financing from a back-office process into a seamless part of the customer journey.

Let’s make every checkout count — online or in-store.

Discover how the right BNPL mix can turn financing into a real growth driver.

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.

Notes

- Navigating the surge in ecommerce fraud ↩︎

- Adapting to BNPL Regulation: A Consumer Financing Perspective for Retailers ↩︎