“For younger Americans, BNPL has evolved from an option to an expectation. It’s an integral part of the digital shopping journey.” — J.D. Power, U.S. Consumer Payments Study 2025

Having spent more than 20 years in the payment industry, we’ve seen trends rise, fade, and return in new forms. Today, as BNPL and consumer financing continue to expand, they increasingly stand as strong complements to credit cards rather than competitors.

Looking closer, one fact has become clear over the years: some generations are more inclined than others to choose BNPL over traditional credit cards. Let’s focus on Gen Z & Millennials, the two age groups reshaping how Americans think about financing purchases.

Gen Z & Millennials Drive BNPL Adoption

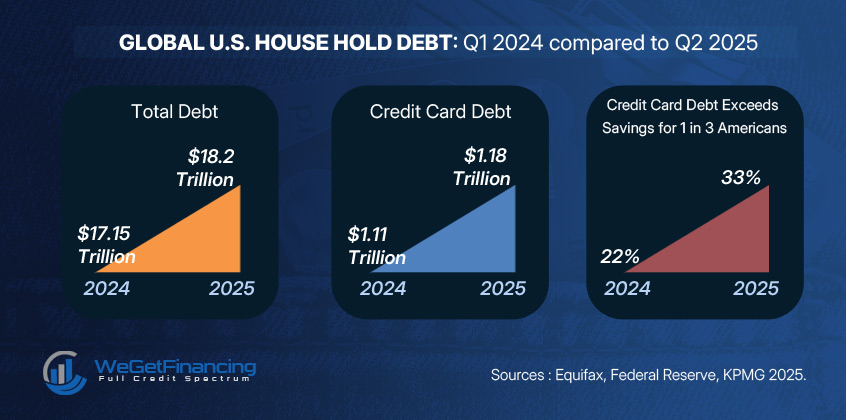

In February 2025, total U.S. consumer debt hit $17.68 trillion, with credit card balances reaching $1.06 trillion, up 4.4% year-over-year (Equifax, Federal Reserve). At the same time, one-third of Americans reported having more credit card debt than savings (KPMG, 2025).

For Millennials and Gen Z, who already face rising living costs and an uncertain job market, traditional revolving credit feels increasingly risky.

Instead, these younger cohorts are embracing Buy Now, Pay Later (BNPL) as a flexible, transparent, and mobile-first way to manage payments. For U.S. merchants, offering BNPL is no longer optional — it’s a competitive advantage in attracting and retaining younger consumers.

Definition: Who Are Gen Z & Millennials?

Millennials were born between 1981 and 1996, while Gen Z includes those born from 1997 onward (Pew Research Center, 2019).

Both are digital natives, but with different outlooks:

- Millennials grew up during the rise of the internet and witnessed the 2008 financial crisis, shaping a mix of optimism and caution.

- Gen Z came of age in a fully digital world — they value immediacy, inclusivity, and transparency, and expect technology to simplify every interaction.

(Sources: Pew Research Center, Deloitte 2024 Global Gen Z and Millennials Survey, Ryan Jenkins, WorldatWork)

Gen Z & Millennials: The BNPL Numbers That Matter

BNPL resonates because it combines instant approvals, predictable installment plans, and app-based convenience — all perfectly aligned with digital-first lifestyles.

- 42% of Gen Z & Millennials used BNPL in 2024, compared with 21% of older generations (J.D. Power, 2025).

- During the 2024 holiday season, 54% of Gen Z consumers used BNPL, surpassing credit card usage (50%) for the first time (Payments Dive, 2025).

- In total, over 79 million U.S. consumers used BNPL in 2024, with Gen Z leading adoption (Absrbd BNPL Statistics, 2025).

These figures don’t just matter in theory — they show up very clearly during peak shopping events. For a deeper look at how Gen Z and Millennials drive BNPL usage on Black Friday and Cyber Week, including category breakdowns and spend forecasts, see our article about Black Friday 2025 and Buy Now Pay Later growth.

BNPL: Not Just a Patch for Compulsive Consumers

“BNPL is not a pandemic phenomenon. It’s a structural innovation in consumer credit that reflects lasting changes in behavior, technology, and trust.”

— McKinsey & Company, Global Payments Report 2024.

As technology and economics evolve, so do consumption patterns. While BNPL can help households manage tight budgets, it’s not merely a crisis tool — nor a shortcut for “irresponsible consumers”. That stereotype often comes from surface-level critiques portraying BNPL as a debt trap, when in fact most users rely on it as a budgeting tool — a reflection of new financial habits rather than reckless spending.

BNPL has become a mainstream financial alternative, offering people of all income levels a smarter way to diversify their payment options and manage personal cash flow. Gen Z and Millennials use it not out of compulsion but as a strategic financial choice.

Why BNPL Resonates During Economic Stress

1. A Safer Alternative to Credit Cards

Average U.S. credit card APRs now exceed 20% (Federal Reserve, 2025). BNPL, by contrast, often offers 0% interest when payments are made on time, with only minimal late fees. For younger generations wary of credit card traps, this feels like a safer and more transparent way to finance purchases.

2. Budget Management & Psychological Relief

Research from Harvard Business Review (2024) shows that BNPL can increase the likelihood of purchase from 17% to 26%, while boosting basket sizes by around 10%. Spreading payments over time reduces psychological resistance and helps young buyers manage monthly expenses more effectively.

3. Expanding Access

With simplified approval processes and soft credit checks, BNPL appeals strongly to consumers still building their credit footprint. It bridges access gaps that traditional lenders often overlook — a crucial advantage for Gen Z entering adulthood.

Impact on Retail: Conversions, Loyalty & Spend

From a merchant’s perspective, the debate is no longer “Should I offer BNPL?” but “How can I optimize it?”

Here, the numbers speak for themselves:

- 20–30% higher e-commerce conversions when BNPL is offered (Affirm, Stripe).

- 30–50% higher average order values (AOV) in sectors such as electronics, apparel, and furniture (Skeps, 2025).

- 45% of BNPL users make repeat purchases with the same retailer (BNP Paribas, 2024).

Even more striking, these results reflect single-lender BNPL systems. Multi-lender technologies now expand access across the full credit spectrum, often outperforming early BNPL benchmarks.

For U.S. merchants, BNPL isn’t just a payment method — it’s a growth engine for conversions, retention, and customer satisfaction. As explored in our analysis of Smart BNPL and Customer Lifetime Value, advanced multi-lender models can directly enhance repeat purchases and long-term loyalty.

From Single Lenders to Advanced BNPL Technologies

The real question today is not when to implement BNPL, but how.

Smart retailers now focus on choosing the right BNPL infrastructure to maximize sales while improving the customer experience.

High rejection ratios from single lenders, unpredictable underwriting rules, or restrictive lending policies can directly hurt conversions. Moreover, reliance on one provider can create conflicts of interest when lenders promote competing products.

That’s why the market is shifting toward independent, retailer-oriented BNPL technologies — featuring simplified checkouts, multi-lender gateways, and intelligent lender mixes designed to:

- Cover the widest credit spectrum possible,

- Increase approval rates, and

- Deliver a frictionless financing experience for every customer profile.

Top Categories Where BNPL Thrives

According to Numerator’s 2025 BNPL Market Insights, Gen Z & Millennials are most active in:

- Fashion & Apparel: 42% of BNPL users financed clothing in 2024.

- Electronics & Gadgets: 32% used BNPL for tech purchases.

- Furniture & Home Décor: 26% turned to BNPL for higher-ticket home items — a trend particularly visible in the furniture sector, where in-store financing through platforms like Storis has become a game changer for retailers using BNPL solutions in-store. Broader market data confirms this shift, as detailed in our BNPL Furniture Market 2025 analysis.

Beyond traditional retail, BNPL is also reshaping how younger consumers access technology. The rise of flexible PC gaming financing options perfectly illustrates Gen Z’s appetite for smart, scalable payment solutions that match both their budget and digital lifestyle.

At the same time, BNPL adoption is accelerating across sectors like travel, healthcare, and education — extending its reach from lifestyle purchases to essential and aspirational services alike.

What Merchants Should Consider Doing

“BNPL has become a fixture in U.S. consumer finance — widely adopted across demographics and now embedded within mainstream retail ecosystems.”

— Federal Reserve Bank of Richmond, Economic Brief, March 2025.

When that reality is this clear, what should be on every merchant’s checklist moving forward?

Integrate BNPL across both online and in-store channels to align with digital-native expectations.

Clearly display repayment terms and total costs at checkout to build trust and encourage responsible use.

Maximize approval rates by connecting to multiple lenders — ensuring more customers can get financed, regardless of credit tier.

Reward customers who use BNPL to reinforce positive engagement and long-term brand loyalty.

Another effective way to improve BNPL performance is to run a BNPL Performance Check. It helps identify approval plateaus, hidden rejection points, and whether financing logic is still aligned with today’s customer profiles.

To Sum Up: The Strategic Use of BNPL by Gen Z & Millennials

Gen Z and Millennials are reshaping the U.S. payment landscape. Amid economic uncertainty, BNPL has evolved into more than a convenience — it’s a financial strategy that helps them manage risk, preserve liquidity, and still access the products they value.

For U.S. merchants, adopting BNPL — especially multi-lender solutions — is essential to staying relevant. Those who embrace smarter financing technologies will gain not only higher conversions and larger baskets, but also lasting loyalty from the next generation of shoppers.

Looking to go further?

Explore how smart consumer financing reshapes retail performance:

- Consumer Financing 2025: The Complete Guide

- BNPL Solutions Aren’t All Equal: Waterfall Lending vs Single-Lender Gateways

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.