“Many merchants can be easily confused by the different BNPL options out there, but for those well-versed in consumer financing, the distinction is clear. Although, on the surface, many BNPL providers claim to cater to all credit scores, but the reality is much more nuanced.”

The “Magic” Of Buy Now Pay Later and Consumer Financing Solutions

When we talk about Buy Now Pay Later (BNPL) solutions, we often call the technology behind them “magic.” And while there’s some truth to that, there’s a lot of depth behind the magic that separates one BNPL solution from another.

Many merchants can be easily confused by the different options out there, but for those well-versed in consumer financing, the distinction is clear. On the surface, many BNPL providers claim to cater to all credit scores, but the reality is much more nuanced. Companies like Affirm, Klarna, or Afterpay operate on very different models from others, especially when compared to more sophisticated solutions like Waterfall lending. It’s important to recognize that basic BNPL offerings—tied to a single lender—often reflect that lender’s interests, policies, and even potential vulnerabilities. In contrast, advanced BNPL technologies foster a competitive landscape, creating better outcomes for both customers and merchants alike.

Think of it like shopping for jeans. A pair of jeans is a pair of jeans, right? But some jeans stretch better, fit more comfortably, or last longer. The same goes for Buy Now Pay Later solutions. They might all offer installment payments, but their strengths vary significantly depending on the financing technology behind them.

Understanding how BNPL technology works gives you the power to choose the right solution for your business.

What Exactly is Buy Now Pay Later and Consumer Financing?

At its core, a BNPL solution is an alternative payment method. Instead of paying upfront with cash, credit, or debit, consumers can split their payments into manageable installments. For merchants, this reduces cart abandonment and boosts sales, especially from hesitant shoppers.

In fact, a Harvard Business Review study (How BNPL is changing customer spending hbr.org) found that BNPL adoption increased purchase likelihood from 17% to 26%. And consumers spent 10% more on average. These spending habits continued for nearly six months—proving that BNPL drives long-term growth, not just short-term spikes.

Are All BNPL Solutions the Same?

Short answer: No.

Think of credit cards. You’ve got Mastercard, Discover, AMEX, and Visa—each with its unique strengths. While they all serve the same basic function, their benefits, fees, and rewards differ. It matters which one you pick based on your needs. If you’re a frequent traveler, AMEX is a no-brainer over Discover.

The same applies to BNPL solutions. Sure, they all help consumers split larger purchases into manageable installments. But the process and execution can vary greatly. These differences go back to the financing technology behind each BNPL solution.

Pulling Back the Curtain: The BNPL Technology Breakdown

The Surface Level of BNPL Technology: The Lender Difference

One of the biggest distinctions in BNPL solutions is the lender involved. Some BNPL providers and companies like Klarna, are backed by a single lender. Klarna offers the BNPL technology, while WebBank provides the funding.

Then there are companies, like WeGetFinancing and Chargeafter, that partner with multiple lenders. These providers essentially function as a financing technology platform. Instead of relying on just one lender, they give customers access to multiple funding sources.

Our suggestion: Opt for a BNPL provider that works with multiple lenders. Single-lender systems can be restrictive. One lender often has narrow underwriting criteria based on specific FICO score ranges or funding limits. This limits the number of customers who can get approved. Moreover, if a lender tightens their criteria due to market changes or risk factors, it can affect approvals and rates.

Multiple lenders, on the other hand, offer a broader spectrum of funding options. It’s diversification at its finest. This increases approval chances and can provide better rates for your customers.

The Middle Layer of BNPL Technology: The Application Process

Now that we’ve covered the surface-level distinctions, let’s dive into how this works from a tech perspective. Different BNPL providers use different applications, and the questions they ask vary widely. Some lenders pull credit scores, while others don’t. Some focus on certain financial criteria while others don’t.

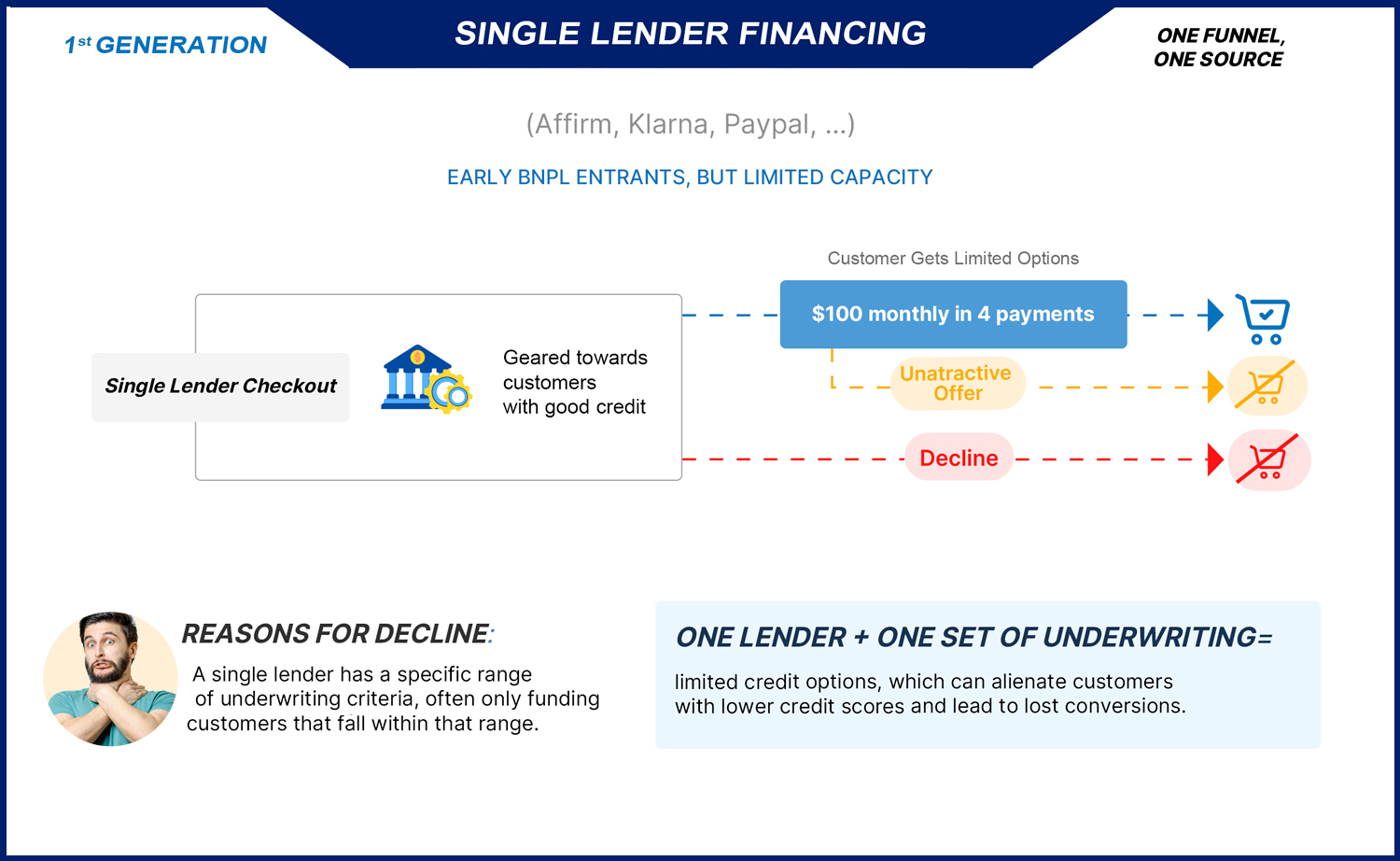

Single-Lender Buy Now Pay Later

According to studies, around 70% of online shoppers abandon their carts before completing a purchase. If a customer gets to checkout, only to be rejected for financing, that golden opportunity is lost.

Single-lender solutions often have a straightforward application process. Whether the provider is the lender outsourcing to one lender (like Affirm, Klarna or Afterpay), the customer only fills out one set of questions. If they get approved, great. If they don’t, the process stops there—leaving you with an abandoned cart.

According to studies, around 70% of online shoppers abandon their carts before completing a purchase (Online shopping card abandonment worldwide, Statista.org). If a customer gets to checkout, only to be rejected for financing, that golden opportunity is lost. With no alternative financing options offered, your customer likely moves on to another site.

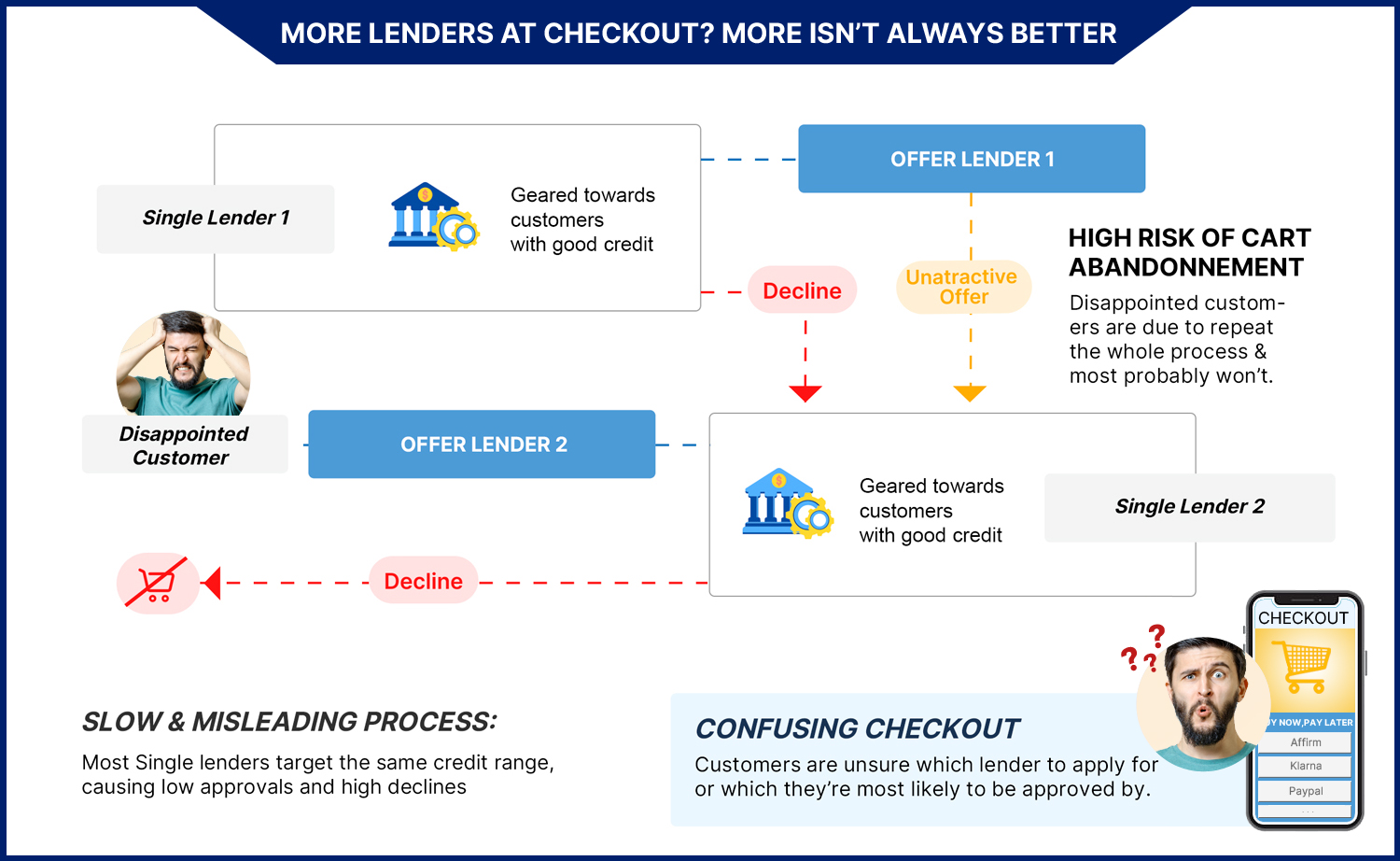

Some retailers see this challenge and think adding multiple single-lender solutions at checkout will solve it. However, this can backfire. Offering too many payment options can overwhelm customers, creating confusion at the checkout. This confusion, even for a second, creates friction and hurts sales.

Multi-Lender BNPL Solutions: BNPL Gateways vs Waterfalls

Multi-lender solutions, on the other hand, allow for more flexibility and options. These systems cater to a wider range of customers by providing multiple lending options. However, they often come with a more complex application process. Why? Because these solutions need to collect more information to meet the different underwriting criteria of each lender.

The key difference between multi-lender BNPL solutions lies in how they process applications. There are two main types: waterfalls and gateways.

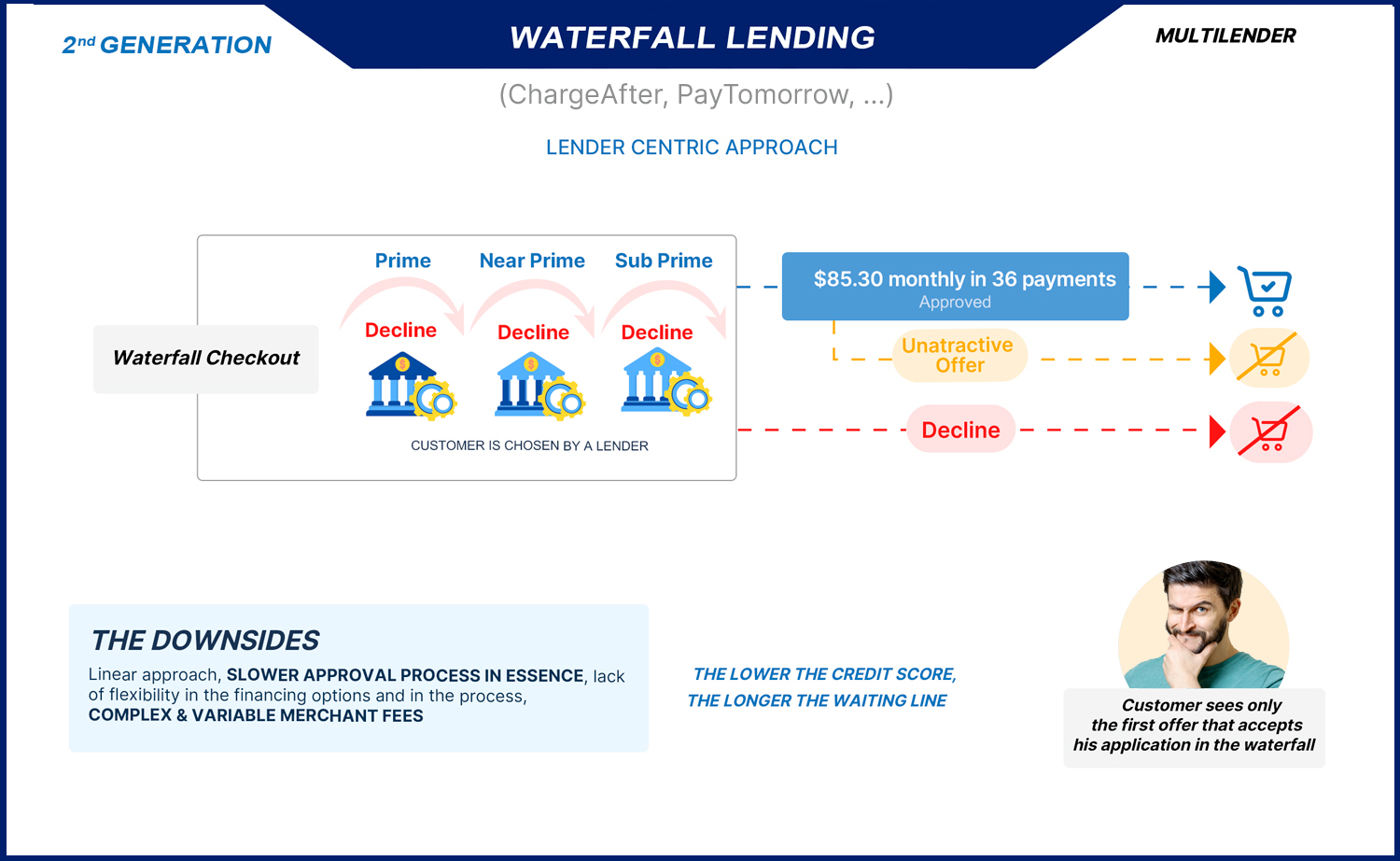

Waterfall Solutions

Waterfall solutions order lenders from prime to subprime, based on the customer’s credit score. Prime lenders typically provide the best rates, as they’re willing to fund customers with excellent credit. Subprime lenders, on the other hand, provide funding to customers with lower credit scores, but charge higher rates to mitigate risk.

When a customer applies through a waterfall system, they fill out a detailed application with questions from each lender. This can be time-consuming and might discourage some customers. Once the information is submitted, the application is processed in order, from the best (prime lenders) to the worst (subprime lenders). The customer then receives an offer from the most suitable lender.

While this is “technically” a multi-lender solution, the outcome is still limited. The result is essentially a single lender offering—just based on a longer, more detailed application. And this can lead to less favorable terms for customers with lower credit scores.

Gateway Solutions

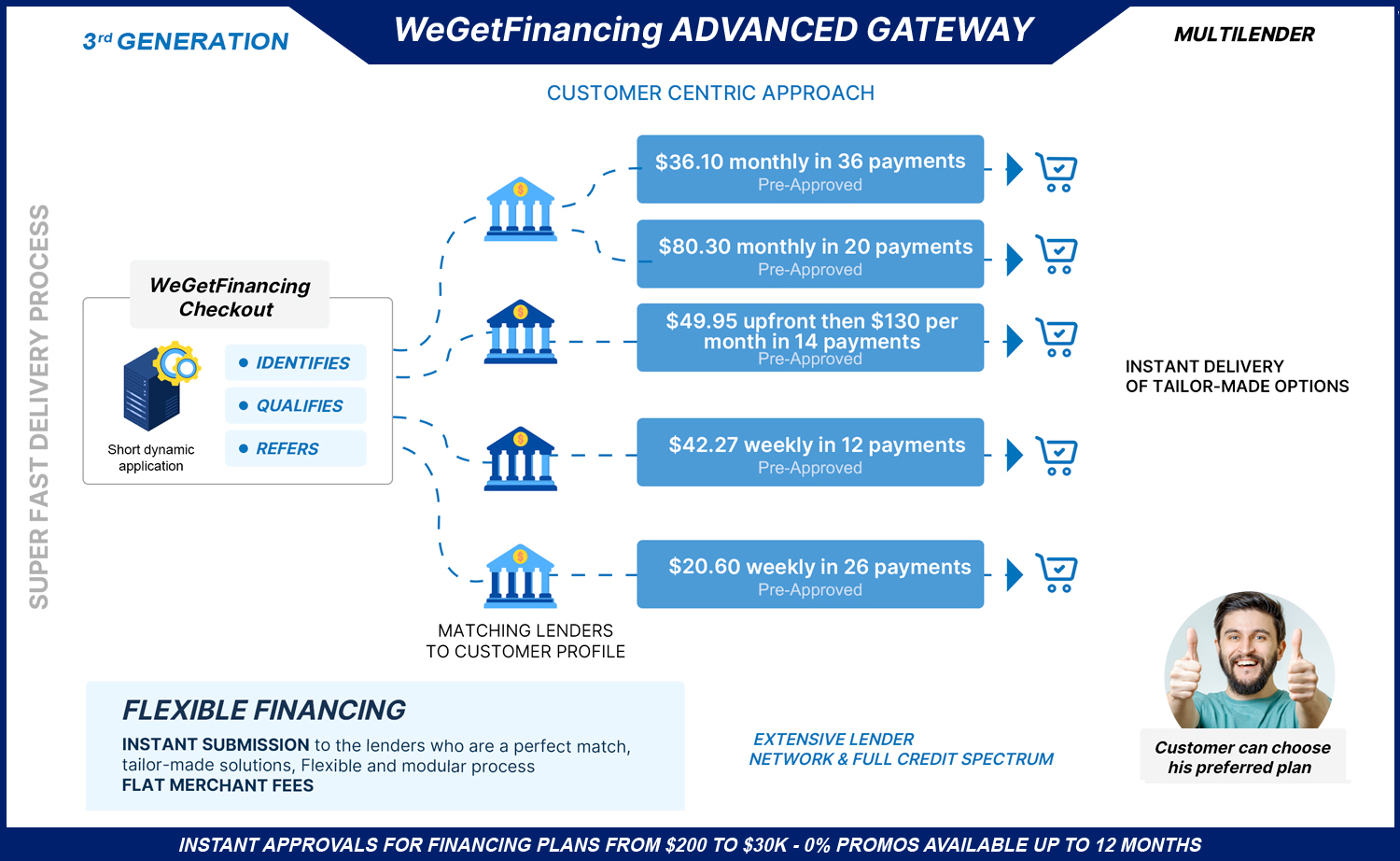

BNPL gateways work more efficiently by combining the ease of a single-lender application with the benefits of multiple lenders. These solutions utilize “IRQ financing technology” (Identify, Qualify, Refer). Here’s how it works:

Before the customer completes the application, the system does a soft credit pull to assess their creditworthiness. Based on the customer’s credit score, the platform determines which lenders they qualify for. Then, it only presents the relevant questions for those specific lenders. The application process is much faster, as it’s more targeted and doesn’t ask unnecessary questions.

The real advantage of a BNPL gateway? After completing the application, the customer is presented with all the offers they’ve been approved for. They can then compare rates in real-time, empowering them to make the best choice. In this case, a single application can lead to multiple lender offers, giving customers more options while still keeping the process quick and efficient.

The clear winner: BNPL gateways. They maximize results by offering a streamlined application like a single-lender with a multi-lender result. This multi-lender logic not only improves approvals — it also drives measurable improvements in customer satisfaction and CLV.

The Third Layer of BNPL Technology: Supporting BNPL Technology and Fraud Detection

Effective fraud detection technology is what separates the good from the great BNPL providers. If a provider allows too many fraudulent transactions to go unnoticed, the lender bears the cost.

Fraud detection is a critical component in the BNPL ecosystem. As BNPL adoption skyrockets in e-commerce, fraudsters are becoming increasingly clever (see Ecommerce Fraud: Strategies for Safety and Security) . A weak fraud detection system can lead to a higher rate of fraudulent transactions, which may result in chargebacks or defaults. When fraud slips through the cracks, it impacts the health of lenders, and in turn, the rates and terms they offer.

Effective fraud detection technology is what separates the good from the great BNPL providers. If a provider allows too many fraudulent transactions to go unnoticed, the lender bears the cost. This, of course, leads to a tighter underwriting process and less favorable terms for customers—something no business wants.

Let’s be honest—fraud can seriously damage the credibility of a BNPL solution. A compromised system can lead to bad experiences for your customers, higher costs for your business, and lower approval rates across the board.

Our suggestion: It’s essential to choose a provider that uses the latest, most advanced fraud detection measures. Look for one that employs machine learning, real-time analysis, and other cutting-edge tools to stay ahead of emerging threats.

While ecommerce and BNPL are frequent targets for fraud, they’re not the only ones though. Tax resolution services are also highly vulnerable, given the sensitivity of the financial data they handle. See how BNPL technology is being used to safeguard this space in our dedicated article on fraud protection in tax resolution.

Conclusion: Choose Your Consumer Financing Technology Wisely

Not all BNPL solutions are created equal. In other words, the “magic” matters. To ensure your customers have a smooth, positive experience—and to protect your business—choose a BNPL provider with flexible technology, multiple lenders, and robust fraud protection.

It’s not just about offering financing; it’s about offering the right financing solution. So when you’re ready to integrate a BNPL solution, make sure you choose one that fits your customers’ needs and empowers your business to grow.