WeGetFinancing has teamed up with Modular Closets to bring their innovative buy now, pay later (BNPL) services to the furniture industry.

A Great Partnership Potential: BNPL Meets Furniture industry

Known for its competitive BNPL solution across various sectors like PC gaming, tax resolution and fitness equipment, WeGetFinancing is expanding its reach into BNPL furniture, starting with a strategic collaboration with Modular Closets.

Over the last few years, the home and furniture sector has witnessed unprecedented growth, with sales reaching almost $64B in 2023. BNPL solutions have shown similar skyrocketing potential– with the proven ability to boost conversion and ticket size both in store and online.

Recognizing the mutual growth between both BNPL solutions and the furniture market, this partnership aims to unite and optimize the two by revolutionizing instant consumer financing for high-ticket items.

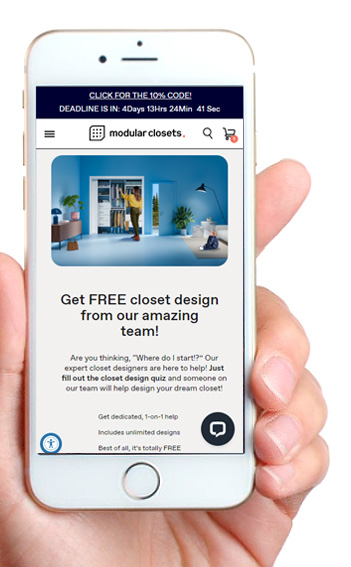

Modular Closets: Simplifying Home Organization

Home is where the heart is. So, finding companies that allow you to maximize the potential of a space to your liking (while accommodating your budget) is critical.

Modular Closets has established itself as a leading provider in the closet industry, known for its standardized units designed for simplicity, organization, and easy installation. First launched in 2015, Modular Closets offers practical closet systems with a commitment to quality, affordability, and elegant design. This dedication is underscored by the fact that they offer free closet design consultations– creating the perfect custom build for each and every customer.

In light of these qualities, Modular Closets aligns perfectly with WeGetFinancing’s mission to provide hassle-free financial solutions. With the integration of WeGetFinancing into the Modular Closets checkout process, customers can now unlock the full potential of their homes without financial strain. This presents a promising new opportunity for furniture retailers who choose to embrace it.

BNPL Solutions: Transforming the Furniture Industry

In 2023, the U.S. furniture industry saw record-high sales of $63.8 billion and an annual projected growth rate of 3.82% from 2024 to 2029, underscoring a growing demand for affordable, yet quality home furnishings (1). WeGetFinancing recognizes the potential in meeting the demand of BNPL furniture solutions, especially when considering the financial strain accompanying high-ticket purchases.

For a deeper look at how financing demand is evolving, explore our full breakdown of the BNPL furniture market in 2025.

Consumer Financing Dynamics

Consumer financing plays a pivotal role in accelerating purchase decisions by alleviating upfront financing burdens. Historically, the furniture industry has pursued consumer financing through more traditional methods like branded credit cards or single-lender solutions. Each of these comes with its own set of limitations– many of which have failed to provide for a broad spectrum of consumers:

- Credit cards, when not paid off in full, often come with hidden fees. This becomes a concern with larger purchases, as they are usually not able to be paid off by the end of a billing month– resulting in boundless accrued interest.

- Single-lender solutions provide very little flexibility. Each lender has its own specific set of lending criteria. If your customers don’t meet those standards, they will be (and often are) turned away.

In response to this, a third option emerges: Buy Now, Pay Later Furniture. Multi-lender BNPL furniture solutions like those offered by WeGetFinancing have begun to gain traffic by providing a flexible alternative to traditional consumer financing. In contrast to standalone and single-lender financing, WeGetFinancing offers a large network of competitive lenders wrapped up in one BNPL solution. This allows for full credit spectrum coverage, maximizing a business’ customer outreach and extending up to 60 months financing.

The BNPL Furniture Impact on Merchants and Customers

By integrating WeGetFinancing into the Modular Closets checkout process, customers gain access to a seamless BNPL furniture experience tailored to their financing needs. This full credit spectrum customization not only enhances affordability but also drives stronger performance metrics for merchants.

Beyond ecommerce-first use cases, BNPL furniture is also gaining traction in physical retail, as demonstrated by Quality Home’s in-store BNPL deployment through STORIS, where financing is embedded directly at the point of sale.

Studies have shown that optimized BNPL solutions can increase average ticket sizes by up to 50% and improve conversion rates by 30% (2). Yet, thanks to its extensive lender network and fast checkout funnel, the WeGetFinancing BNPL gateway is designed to perform well above these metrics and expectations.

With its partnership with Modular Closets, WeGetFinancing is poised to reshape the furniture industry by offering a more accessible and flexible payment solution. By embracing BNPL furniture, both companies work to empower consumers to enhance their living spaces affordably and stylishly.

Notes

(1) Source Statista.com Furniture and Furniture Retail.

(2) Source Pymnts.com Buy Now Pay Later