BNPL adoption and approval rates are widely discussed.

But detailed visibility into accepted versus rejected transactions often remains the invisible elephant in the room.

Public BNPL reporting largely focuses on adoption, usage, and repayment behavior.

Approval coverage, checkout rejection rates, and financing-path mismatches are rarely exposed, not because they are insignificant, but because they are difficult to track with standard tools and are not typically disclosed by most fintech providers in this space (see CFPB BNPL reports).

As a result, many merchants scale traffic and marketing without ever seeing where high-intent demand quietly drops off.

How Unseen BNPL Rejections Quietly Limit Growth?

When a customer is rejected at checkout, most merchants move on.

The cart is abandoned.

The event may be logged — or ignored.

Attention quickly shifts back to traffic, conversion rates, or acquisition costs.

In traditional e-commerce, that logic often made sense. Retargeting campaigns could recover a portion of abandoned carts, and lost demand could be partially offset with additional traffic.

But in BNPL and consumer financing, rejection happens at the worst possible moment: after intent is fully formed.

The customer chose the product.

Accepted the price.

Reached the final step.

When financing fails at that point, the loss is rarely visible but it’s real. And as traffic costs rise and margins tighten, these silent failures begin to cap growth.

BNPL conversions vs rejections

What Merchants See

- Traffic

- Conversions

- BNPL adoption

What Stays Invisible

- Rejection by profile

- Approval gaps

- Lost high-intent buyers

That gap matters because financing rejection usually happens after intent is fully formed — at the very end of checkout.

Early BNPL Was Built for Growth, Not for Optimization

Buy Now, Pay Later solutions originally emerged as a powerful growth lever. They lowered the barrier to purchase, increased conversion rates, and opened access to higher ticket items for a broader range of customers.

For a long time, this model delivered exactly what it promised.

Early adoption phases were driven by expansion: more traffic, more volume, more sales. BNPL filled a natural gap at checkout, offering a more flexible alternative to credit cards and unlocking new purchasing behavior.

In that context, rejection rates were rarely questioned. They were seen as acceptable collateral, easily offset by new demand. Growth masked inefficiencies.

When a financing application failed, the outcome was simple. The cart was abandoned, the event was barely tracked, and focus shifted back to traffic acquisition or conversion optimization.

That logic held while growth was easy. The problem starts when traffic costs rise and every sale begins to matter.

Rejection Is Not the Same as Lack of Demand

It may sound obvious, but it’s an important distinction: a rejected customer is not someone who didn’t want to buy.

In most financing journeys, rejection occurs at the final stage of the checkout process :

- The product is selected

- The price is accepted

- The intent is real

The only thing that fails is the financing decision.

When that happens, the merchant doesn’t lose a casual visitor.

They lose a qualified buyer who was ready to convert, but encountered a financing path that did not fit their profile.

The Silent Nature of Financing Rejection

As BNPL adoption grows, visibility into rejected transactions — and optimization of financial routing — becomes critical. More applicants mean more diversity, not proportional approval rates. Popularity is not coverage.

Unlike payment errors, bugs, or technical outages, financing rejection is almost invisible.

There is no alert to warn the merchant.

There is no clear complaint from the customer.

There is no obvious spike in error reporting or system logs.

The customer simply leaves.

Over time, this silence creates a misleading sense of stability. Traffic appears healthy. Conversion rates look acceptable. BNPL usage seems active. Yet revenue growth begins to slow, without an obvious explanation.

Because rejection leaves no trace, it quietly becomes part of the background, even as it erodes performance. As BNPL adoption increases and customer profiles widen, the issue naturally scales with it.

Why Rejection Compounds Over Time?

The cost of a rejected financing application is rarely limited to a single lost sale.

Each rejection can lead to:

A lost immediate sale

Reduced likelihood of return

Lower brand trust

Negative word-of-mouth

Over time, these silent exits accumulate and form a structural drag on growth.

This effect is especially strong for high-ticket or considered purchases.

When financing fails, customers rarely “try again later.” They simply complete the purchase elsewhere.

Why Merchants Underestimate Financing Rejection?

Most teams track what is easy to measure.

They monitor traffic volumes, conversion rates, average order value, and overall BNPL adoption. What they rarely see is what happens inside the financing decision itself.

Very few merchants have visibility into approval coverage by customer profile, rejection-driven drop-off, or revenue lost due to financing mismatch.

As a result, rejection becomes normalized, treated as an unavoidable part of offering financing rather than a signal worth investigating. In many cases, it is simply ignored because it remains unseen.

When rejection isn’t measured, it cannot be optimized. This is why reviewing approval paths and rejection visibility — before scaling traffic — is often more impactful than adding another payment option. ( BNPL Performance Check)

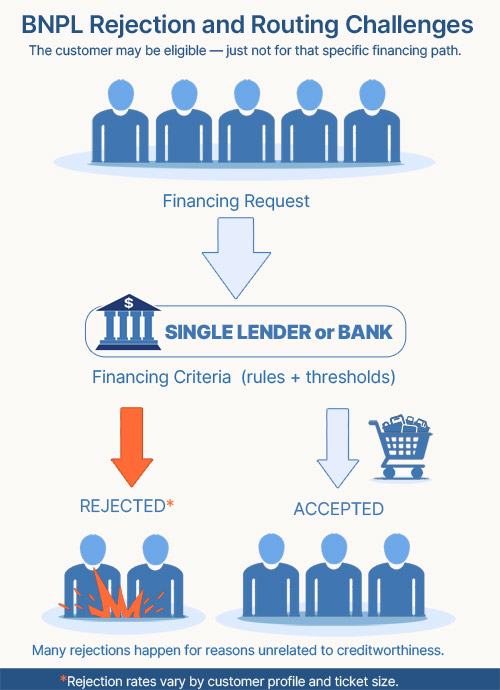

Rejection Is Often a Routing Problem, Not a Credit Problem

A common assumption is that financing rejection means the customer is not creditworthy.

In practice, many rejections happen for reasons unrelated to creditworthiness.

The financing option may not fit the customer profile, the ticket size may exceed a provider’s comfort zone, or the buyer may simply fall between underwriting criteria.

The customer may be eligible — just not for that specific financing path.

When only one BNPL or POS financing logic is applied, good customers are filtered out unnecessarily. The issue is not always credit risk. It is often coverage and routing.

In many cases, the fix is not “more demand” — it’s better lender coverage. Adding multiple BNPL options at checkout does not guarantee higher approvals. Rejection at the moment of decision often ends the journey.

A multi-lender gateway can route applicants to a financing option that fits their profile and ticket size, instead of forcing everyone through one set of criteria.

When Financing Stops Scaling With the Business

As businesses grow, their customer base naturally becomes more diverse.

Ticket sizes increase. New age groups enter the funnel. Omnichannel journeys multiply. Credit behaviors evolve. A financing setup that worked well at one stage can quietly become a limiting factor at the next.

This is where merchants often experience plateauing average order value, declining approval rates, or uneven performance across channels. Demand has not disappeared — financing simply stopped adapting. Without visibility into rejection, the ceiling remains invisible.

The Strategic Cost of Misdiagnosing the Problem

When rejection is not clearly understood, teams often respond to the wrong signals.

- Increasing marketing spend

- Discounting products

- Simplifying offers

- Blaming customer quality

These actions may temporarily improve surface metrics, but they do not address the underlying issue.

The financing structure remains unchanged, and rejection continues to operate quietly in the background. The underlying issue remains untouched.

Making Rejection Visible Again

Rejected customers should not be treated as failures. They are signals.

They indicate that financing logic, lender coverage, or approval paths may no longer align with customer profiles, ticket sizes, or growth ambitions.

Making rejection visible is not about assigning blame. It is about restoring alignment between intent and approval.

Ignoring those signals doesn’t just cost individual sales.

It limits long-term performance.

Key Takeaway: Rejection Is a Signal

1. Rejected customers don’t indicate weak demand.

They reveal invisible friction at the moment of decision.

2. Rejection itself isn’t the problem.

What limits growth is failing to measure and understand it.

When financing logic no longer matches customer reality, performance plateaus — quietly.

How to Move Forward?

When financing rejections are visible, they stop being a cost and start becoming a signal.

Understanding gaps, improving transparency, and reassessing financing logic often reveals growth that already exists, but remains untapped.

This is exactly what a BNPL Performance Check is designed to uncover.

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.