Level Up: How PC Gaming and Consumer Financing Are a Match Made in Digital Heaven.

Let’s talk about the $47.5 billion-dollar industry that’s taken over bedrooms, basements, and Twitch streams worldwide—the gaming computer market. 1. It’s more than a hobby. It’s a lifestyle, a tech obsession, and for many, a full-blown identity.

From RGB-lit battlestations to water-cooled CPUs, this is not your average gaming setup. It’s high-performance tech meets pure passion. And it doesn’t come cheap. In 2025, a solid PC gaming setup can start around $1,000 — and easily climb to $3,000, $4,000, or even more for a high-performance custom build.

That’s where consumer financing steps in—bridging the gap between dream builds and actual budgets. Whether it’s PC financing, Buy Now Pay Later (BNPL), or full spectrum finance for gamers with a low credit score, these options make it possible to level up without financial freefall.

For younger consumers—especially Gen Z—BNPL solutions and POS financing offer a modern, secure, and flexible way to support the hobbies they love. And let’s be real: a new gaming setup might not be “essential,” but for millions, it’s essential to who they are.

Gaming Isn’t Just Plug-and-Play Anymore

Gone are the days of buying a boxed game and popping it into a console. Today’s PC gamers are building entire systems from scratch—meticulously selecting graphics cards, processors, storage, and more. It’s like crafting a digital supercar, except your tires are SSDs and your horsepower comes from Nvidia. Customization is the name of the game. And customization costs. This is where PC financing with BNPL enters stage left—a stage that’s now both digital and physical.

“Omnichannel flexibility in PC financing is what sets apart growth-minded PC retailers from the rest.”

Fortunately, some modern POS financing solutions work seamlessly across online checkouts and in-store terminals—using QR code applications, prequalification flows, or staff-assisted tablets to bridge the gap. Since 2024, the WeGetFinancing gateway and Sensepass have partnered to deliver exclusive in-store and omnichannel financing solutions.

Whether it’s configuring a $3,000 gaming rig online or getting one built in-store, merchants who embed advanced financing directly into the shopping experience are meeting customers where they decide—not just where they pay. In 2025, this kind of omnichannel flexibility in POS financing is what truly sets forward-thinking PC retailers apart.

Why Financing for Gaming PCs Makes Sense

Let’s say you’re a 22-year-old Gen Zer with big gamer dreams. You want a custom rig that runs Elden Ring on ultra settings and still checks email on the side. Problem? Your dream setup costs more than your first semester of college textbooks.

That’s where PC financing, Buy Now Pay Later options, and other payment solutions come in clutch. It’s not just about affordability—it’s about access, flexibility, and freedom. The rising popularity of BNPL in the PC gaming world is also reshaping how both consumers and retailers approach high-performance builds.

BNPL & Gen Z : Meet The Next-Gen Gamers and Buyers

“42% of Gen Z and Gen Y are reported using BNPL solutions, compared to just 21% of consumers from other generations“

These gaming trends mirror broader generational shifts, as our Gen Z & Millennials BNPL 2025 analysis shows — younger shoppers increasingly expect flexible, transparent payment options across all major purchase categories.

Born between 1997 and 2013, Gen Z is the first generation raised entirely in a digital world. They’re tech-native, customization-obsessed, and extremely financially aware. They’re also leading the pack when it comes to BNPL adoption—and they’re not alone.

Recent studies show that Gens Y and Z are utilizing Buy Now Pay Later the most. In fact, 42% of them reported using BNPL solutions, compared to just 21% of consumers from other generations (source JDpower.com). And there’s more: during the 2024 holiday season, more Gen Z consumers reported using BNPL over credit cards — a historic first in the study’s history. This seasonal inflection point matters, particularly for high-ticket categories like gaming hardware, where deferred purchases often convert at year end. We explored this dynamic in detail in our analysis of how BNPL impacts high-ticket PC gaming purchases during Christmas.

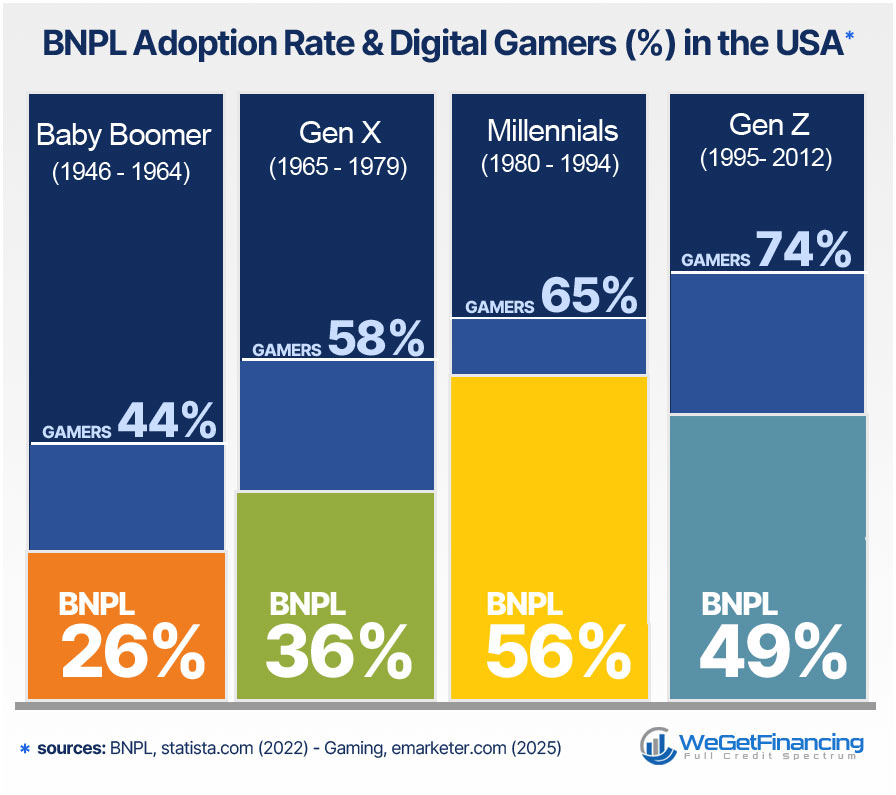

An earlier study from Statista (2022) found even higher adoption rates, with 56% of Millennials and 49% of Gen Z reporting they had used BNPL services. And here’s where it all connects: Gen Z and Millennials are also the dominant force in digital gaming. According to another Statista and emarketer estimate, 74% of Gen Z in the U.S. were active digital gamers in 2025 — a 13% increase since 2019. Millennials came second, with roughly two-thirds engaging in gaming as well.

1. Why Gen Z Embraces BNPL and POS Financing

This shift shows more than just preference. It highlights a realignment in consumer expectations. These younger buyers are actively seeking competitive repayment terms, ditching traditional credit models in favor of BNPL’s transparency and flexibility. Credit cards come with hidden fees and compounding interest. Buy Now Pay Later products? They feel more intuitive and less risky—especially for young adults managing tight budgets and student loans.

So while older generations might scoff, Gen Z is out here making smart, values-driven decisions about how they spend—and how they pay. BNPL and point-of-sale (POS) financing are flexible options that give Gen Z the power to build the setup they want—without revolving credit or complicated paperwork. This kind of financing feels like a tool, not a trap. On the merchant side, POS financing solutions make it easier to meet Gen Z wherever they shop: online, in-store, or anywhere in between.

2. Let’s Talk Credit (And Why Gen Z Is Underestimated)

Here’s the stat that made headlines: Gen Zers, ages 22–24, now carry more credit card debt than millennials did at their age. According to emarketer.com2, on average, they owe $2,834 in Q4 2023—compared to $2,248 (adjusted for inflation) a decade ago. That’s a 26% increase. Sounds scary, right? Older generations might call it irresponsible. But let’s dig deeper.

3. Gaming? Not the Culprit: The Real Gen Z Spending Data

Despite what critics might say, Gen Z gamers actually spend less on games than millennials 3

PC Gaming and Gen Z: Not the Overspenders You Think

28% of Gen Z gamers spend nothing on games.

Only 35% of Gen Z spend over $10/month on in-app purchases.

Millennials are 43% more likely to spend money in-game

So let’s squash the stereotype right here. Gaming isn’t draining Gen Z wallets. Inflation is.

4. Life Costs More Now—A Lot More

Take college tuition as a benchmark. In 1990, average public tuition cost $1,780 4 . Adjusted for inflation? That’s $4,355 today. Current tuition? $9,750 in-state and $27,146 out-of-state. That’s a 124%–523% increase over three decades.

So yes—Gen Z is carrying more debt. But they’re also paying more for everything. And still trying to enjoy life. Can we really blame them for wanting flexibility, especially for those with low credit scores?

PC Financing Gives Gamers Breathing Room

“In a world where inflation eats away at spending power, flexibility matters more than ever. BNPL isn’t a crutch—it’s a bridge.“

Enter consumer financing. With the right payment solutions, Gen Z gamers don’t have to choose between a textbook and a GPU. They can pursue their education and their passion projects—like streaming, game design, or competitive esports. It’s not a luxury. It’s a lifeline. And when done responsibly, it’s actually a powerful tool for financial autonomy.

➤ Full Spectrum Finance: Payment Solutions for Every Credit Score

Another myth worth busting? That financing is only for people with excellent credit. Thanks to full spectrum finance, there are now solutions for every credit tier—even low or limited credit scores. It’s not just about approvals. It’s about creating a system where young consumers can start building healthy financial habits. PC financing becomes more than a transaction. It becomes a teaching moment.

➤ PC Gaming Financing Example: A Look at Origin PC

Did You Know?

Origin PC’s average gaming desktop runs $3,983. With WeGetFinancing’s PC Gaming Financing and full-spectrum BNPL, even students with thin credit files can access flexible plans starting at just a few dozen dollars a month. On more basic setups, financing a solid gaming config or a good laptop can start under $50/month.

To see this in action, let’s look at Origin PC—a leading name in the custom gaming space. If you’ve ever watched tech YouTubers like JayzTwoCents or Gamers Nexus, you’ve probably seen an Origin build. These rigs are top-tier. They’re also not cheap. The average base desktop runs around $3,983. Their entry-level gaming laptops? About $2,822. And that’s before you add any customization.

We’re not talking casual purchases here. We’re talking investment-level equipment. So what does Origin do? They offer financing right on their site. Before you even hit “add to cart,” you can see your estimated installment plan. It’s smart, it’s transparent, and it reduces checkout friction like a boss.

BNPL Solutions: Not Just a PC Financing Buzzword

Let’s break down Buy Now Pay Later. It’s not just marketing fluff—it’s a payment model tailored to today’s consumer. Buy Now Pay Later options allow buyers to:

- Split costs into manageable installments

- Avoid traditional interest-heavy credit cards

- Make large purchases without draining savings

Still, not all BNPL or POS financing solutions are created equal. The popular “Pay-in-4” structure—splitting a purchase into four equal payments—can fall short in industries like gaming, where even a modest build can hit the $3,000–$4,000 mark. Divide that by four, and you’re still staring down $750 to $1,000 per payment. That might work for a phone or a pair of sneakers, but for many gamers—especially students or part-time workers—it’s far from accessible.

This is where more adaptive financing models step in, offering longer-term plans with smaller, more realistic monthly payments. These alternatives aren’t just helpful—they’re necessary to keep pace with rising tech costs and real-world financial pressures. In a world where inflation eats away at spending power, flexibility matters more than ever. BNPL isn’t a crutch—it’s a bridge.

➤ PC Financing That Converts: Full-Spectrum Beats One-Size-Fits-All

Why a Full-Spectrum Gateway Like WeGetFinancing Makes the Difference

Higher approval rates

& better conversions

More customers

get to checkout.

We route each shopper to the right lenders —no more “one-size-fits-none” declines.

Reach Gen Z

& first-time buyers

Even limited credit

isn’t a barrier.

Thin-file shoppers get real financing options, not automatic rejections.

Shop Anywhere:

in-store or online

Omnichannel-ready financing.

Offer PC Financing at any touchpoint: e-commerce, retail, hybrid checkout flows, …

Flexible, competitive lender logic

No single-lender bottlenecks.

A full network competes to serve each buyer—smarter matching, better outcomes.

➤ PC Financing and the Future of Gaming

The gaming industry isn’t slowing down. And neither is Gen Z’s appetite for tech. With consumer financing, they’re better equipped to keep up—without going under.

Greater access to PC Gaming Financing and POS financing solutions means :

- More access to high-performance gear

- Better opportunities to stream, compete, or create content

- More confidence navigating their personal finances

It’s a win-win for gamers and retailers alike.

TL;DR? Here’s the Recap:

- PC gaming is a $47.5B industry rooted in customization and tech passion.

- Gen Z is the main audience—and the most adaptive to consumer financing and POS financing solutions.

- Consumer financing provides critical flexibility, especially in a world where costs keep rising.

- Gaming isn’t the problem—inflation is.

- Origin PC proves that integrating financing into the sales funnel is a friction-killer and conversion booster.

- Full spectrum finance makes it possible for every gamer (even those with low credit scores), to play without compromise.

Final Thoughts: Let’s Keep It Real

Gen Z doesn’t need financial lectures. They need tools. And with the right payment solutions, they can game smarter—not harder. Whether it’s slaying dragons or paying for their next GPU in monthly chunks, fair and flexible PC financing helps them play their way. Because the next generation of gamers? They’re not just players. They’re creators, streamers, coders, and innovators.

And they deserve a system that meets them where they are—on their terms.

Ready to Offer PC Financing That Actually Works?

Whether you’re selling gaming laptops, full rigs, or performance components, WeGetFinancing helps you meet every customer where they are. No hard stops. No dead ends. Just smarter approvals and more revenue.

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.

Notes

- PC gaming worldwide – statistics & facts, Statista.com ↩︎

- Why Gen Z’s credit card activity is raising red flags, emarketer.com ↩︎

- Genz Gaming Who’s Playing What, lab42.com ↩︎

- Average cost of College per year, educationdata.org ↩︎