Every year, WeGetFinancing strengthens its position in the financing and BNPL market. New retailers join, new platforms go live, and our team brings one more set of integrations to life.

After a full year of collaboration with merchants, partners, and technology teams, we felt it was the right moment to step back and highlight where WeGetFinancing works today and how these integrations make Smart BNPL effortless for merchants.

This page is your one-stop guide to the WeGetFinancing BNPL integration across ecommerce, in-store, and vertical software platforms.

1. The WeGetFinancing Gateway : Multi-Lender BNPL at Checkout

Here’s a clear, up-to-date overview of our current integrations, how merchants can activate them, and what makes our multi-lender BNPL gateway different in 2025. Whether you sell online, in-store, or via a vertical SaaS like IRS Logics or Storis, this page gives you a clear snapshot of where we get and what’s next.

Most financing providers force merchants into a single-lender model. We don’t.

How It Works — and Why It’s Different?

The WeGetFinancing gateway acts as a multi-lender BNPL router, allowing every customer—prime, near-prime, and subprime—to receive the best financing option available to them.

The WGF BNPL Flow

One checkout flow

1. One unified checkout for instant financing requests.

Multiple lenders

2. Applications are evaluated by multiple lenders simultaneously.

Instant offers

3. Customers receive instant, personalized financing offers.

What this means in practice:

- We are independent from lenders (no single-lender lock-in).

- We operate one unified integration for all lenders.

- The system automatically matches customers to the right lender in real time.

- Merchants benefit from higher approval rates, bigger AOV, and less friction.

WeGetFinancing Gateway vs Single-Lender BNPL (At a Glance)

BNPL is now a well-established payment alternative, but it can still feel confusing from a merchant’s perspective. Consumer financing has evolved, BNPL providers have multiplied, and the value of each solution is not always obvious. Is Affirm the same as Klarna? What’s the difference between a single-lender model and a BNPL gateway? Which one fits my business model and my shoppers?

In 2025, smart BNPL solutions must combine regulatory compliance, customer transparency, and seamless checkout integration. They also need to address financing routing issues that often go unseen, yet directly impact approvals and conversion rates (see the hidden cost of BNPL financing rejections).

To make the difference clear, here’s how a multi-lender BNPL gateway compares to traditional single-lender providers often used in ecommerce and retail:

| Feature | Single-Lender BNPL (Affirm, Klarna, etc.) | WeGetFinancing BNPL Gateway |

|---|---|---|

| Credit Spectrum | Prime / near-prime only | Full credit spectrum (prime → subprime) |

| Checkout Funnel | 1 checkout = 1 lender | 1 checkout → multiple lenders |

| Approval Logic | Approved or declined | Smart routing & simultaneous offers |

| Coverage | Limited programs | Multiple loan programs (pay-in-x, installments, revolving, etc.) |

| Merchant Impact | Lower approvals | Higher approval rates + higher AOV |

To understand how single-lender BNPL, gateways, and waterfall models differ, you can also explore our guide: Not All BNPL Are Equal.

Security, Verification, and Anti-Fraud

Concerns around BNPL security have been in the news, and merchants naturally want reassurance. This is precisely where WGF stands out. We rely on a layered verification stack powered by trusted third-party providers:

- ID Verification & SSN Checks → DataX / Equifax

- Device Fingerprinting & Geo-Validation

- SMS & Email Verification → Twilio

- Soft Credit Pulls → TransUnion

- Continuous Identity & Address Checks → LexisNexis

Thanks to this architecture, WGF is the preferred choice for merchants operating in regulated or risk-sensitive environments.

For a broader understanding of today’s digital threats, we’ve also published an in-depth guide on how ecommerce fraud is evolving and how businesses can stay protected — including the role BNPL can play in reducing exposure (see Navigating the Surge in Ecommerce Fraud).

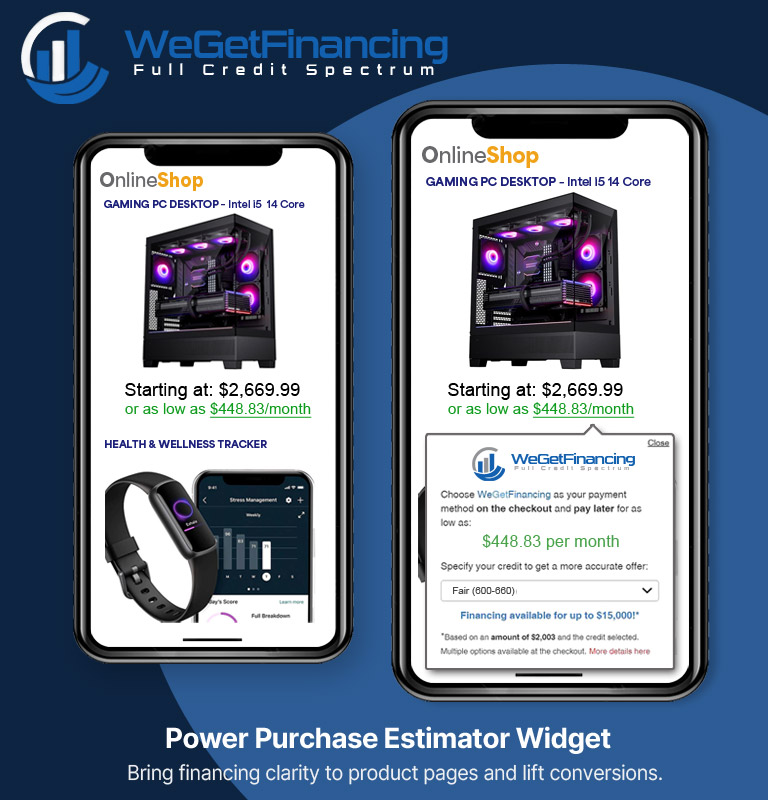

2. Sales Booster: The Power Purchase Estimator

Beyond our standard checkout gateway, the Power Purchase Estimator is our signature pre-checkout component.

Easy to activate and install, it displays realistic monthly payment options directly on product pages, helping customers understand affordability long before they reach checkout.

Benefits for merchants include:

- Increased engagement

- Higher product-page conversion

- Higher AOV and more completed carts

- Less sticker shock at checkout

This additional component is available across every platform where our main gateway is supported.

Where WeGetFinancing Works Today

WeGetFinancing now integrates across a broad ecosystem of solutions — ecommerce platforms, in-store systems, digital wallets, ERP tools, and industry-specific software. Below is a complete and up-to-date overview of everywhere merchants can activate our BNPL gateway today.

| Logo | Platform | Plugin Version | WeGetFinancing Gateway | Purchase Power Estimator | Category |

|---|---|---|---|---|---|

| Shopify | 2024-04 | ✔ | ✔ | Ecommerce | |

| WooCommerce | 7.3–7.9, 8.0–8.9, 9.0 | ✔ | ✔ | Ecommerce | |

| BigCommerce | Latest | In process | — | Ecommerce | |

| Adobe Commerce / Magento | 2.4.4 / 2.4.5 / 2.4.6 | ✔ | ✔ | Ecommerce | |

| SensePass | Latest | ✔ | — | In-Store | |

| Storis | Latest | ✔ | — | In-Store / Furniture | |

| IRS Logics | Latest | ✔ | — | Tax Resolution | |

| Home API / Custom API | — | ✔ | In process | Flexible (Custom Environments) |

WeGetFinancing offers native plugins for major ecommerce platforms including Shopify, WooCommerce, BigCommerce, and Adobe Commerce. Once enabled, the gateway and Power Purchase Estimator integrate financing directly into your product pages and checkout — without modifying your stack.

Our partnerships with SensePass, Storis, and IRS Logics bring the same multi-lender BNPL experience into in-store and vertical workflows. Whether online or in person, the financing process remains unified and frictionless.

Visit our Documentation Center for up-to-date integration information. Ecommerce developers can also access our plugin repository on GitHub.

Activation & Onboarding

No merchant should have to wrestle with complicated integrations or piles of paperwork just to offer financing. That’s why signing up for WeGetFinancing is intentionally simple:

- One merchant onboarding form

- Fast activation

- We manage lender documentation

- Unified reporting and settlement

This applies equally to e-commerce stores and brick-and-mortar retailers.

In-Store BNPL with WeGetFinancing

In-store financing is now one of the fastest-growing BNPL segments. As shoppers increasingly expect tap-to-pay simplicity and mobile-first checkout experiences, Millennials and Gen X consumers are also driving demand for flexible financing options right inside the store.

WeGetFinancing supports physical retailers through two major partnerships:

WeGetFinancing x SensePass

What is SensePass?

A universal payment orchestration platform used in-store to support all payment methods—from credit cards to digital wallets to BNPL.

What does the integration bring?

- BNPL available on the shop floor

- Immediate customer financing via QR, NFC, or payment tablet

- No website required

- Perfect for furniture, electronics, home goods, and other high-ticket retail

How to activate

Merchants already using SensePass can activate WGF with their account manager. Others can contact either company to start.

For a real-world look at how this partnership works in-store, read our detailed article on the WeGetFinancing x SensePass integration for high-ticket in-store BNPL.

BNPL Furniture: WeGetFinancing x STORIS

What is STORIS?

STORIS has steadily grown into the leading retail software platform for large furniture retailers across the United States.

What does the partnership include?

The idea behind this integration is simple: give BNPL furniture retailers instant access to WeGetFinancing’s multi-lender financing directly inside their STORIS workflow, combined with fast, mobile-friendly checkout options such as Tap & Pay. No more paperwork, no approvals lost in long lines, no friction at the point of sale.

Fully integrated into the STORIS platform, the WeGetFinancing solution offers:

- Embedded multi-lender BNPL inside the Storis checkout

- Perfect for in-store financing

- A proven way to increase approval rates for expensive furniture purchases

- Used today by major retailers including Quality Home, featured in one of our blog case studies.

Activation

Merchants already using STORIS can enable the WeGetFinancing app directly from their integrations module. You can learn more in our full overview on the WeGetFinancing × STORIS BNPL setup, or by downloading the STORIS merchant brochure.

If you’re interested in the broader opportunity, our analysis of the BNPL Furniture Market in the U.S. highlights why this segment is expanding rapidly and why multi-lender financing is becoming essential for high-ticket retail.

Tax Resolution Financing : WeGetFinancing × IRS Logics

Tax resolution firms face one of the most complex forms of consumer risk assessment. As discussed in our Expert Opinion series with Eithan Touboul, this is a highly specialized market where deep expertise is essential to adapt financing solutions to individual cases.

To say “yes” to more clients, firms need a strong multi-lender solution that ensures independence, rigorous verification, and powerful anti-fraud measures. This is why WeGetFinancing has become the leading financing partner for the tax resolution industry.

How the integration works?

- Customers apply directly inside the IRS Logics CRM

- WeGetFinancing routes each client to multiple lenders based on their financial profile

- Consultants close more cases because affordability barriers disappear

What firms get?

- Higher acceptance rates than single-lender credit programs

- Lower friction during client intake

- A smart, compliant financing experience built for sensitive financial situations

To understand how this integration improves intake, conversion, and case outcomes, you can read our complete overview on Tax Resolution Firms & Consumer Financing.

Thanks for reading — we hope this integration overview helps you navigate your BNPL options with clarity and confidence. If you’re ready to move forward, here’s how to get started with WeGetFinancing:

Get Started with WeGetFinancing

If you’re ready to grow with Smart BNPL, here’s the best way to get started:

1. Start Onboarding Today

Create your merchant account in just a few minutes.

2. Already using one of the platforms above?

Shopify, WooCommerce, BigCommerce, STORIS, IRS Logics…

Simply install the plugin or enable the integration directly from your system.

For custom environments, we also offer free support and a free evaluation to guide your integration.

3. Talk to an Expert

Have questions about your business model or technical setup? Get in touch — we’re always happy to help.

The WeGetFinancing Editorial Team

Expert insights on BNPL, consumer financing, and retention strategies.