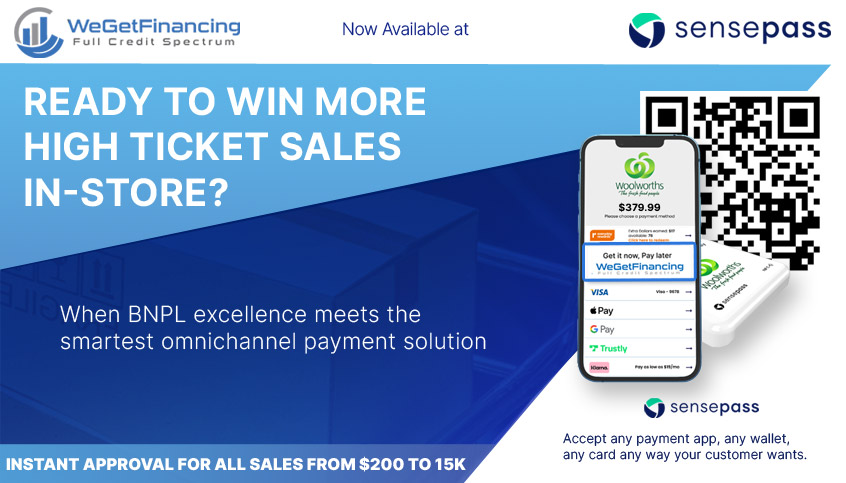

SensePass merchants can now offer BNPL in-store financing for larger tickets—up to $15,000.

Two platforms, one full-credit spectrum experience. WeGetFinancing, a Buy Now, Pay Later (BNPL) consumer financing solution, and SensePass, an omnichannel payment platform, have joined forces– pushing traditional lender limits to create a frictionless experience for brick-and-mortar POS systems in the U.S. This partnership brings BNPL in-store to life, enabling retailers to offer instant financing options at the point of sale with the same flexibility shoppers expect online.

The Rise of E-Commerce Payment Diversity

Today, most online purchases offer diverse payment options beyond the traditional credit card. These methods are designed to drive sales volumes by accommodating payment preferences, a feature customers have begun to expect.

Of these ecommerce payment solutions, BNPL solutions are a common option. Renowned for their ability to provide flexible financing to customers, BNPL offers can not only encourage an increase in average order value, but can also boost overall conversion rates.

High-Ticket Capabilities of WeGetFinancing

WeGetFinancing has established itself as a prominent player in the consumer financing market, catering largely to high-ticket sales. Our BNPL technology seamlessly integrates with leading third party shopping platforms to provide customers with a tailored suite of lenders for tickets up to $15,000 with 60 months financing. By offering comprehensive financing options across the credit spectrum, our platform empowers retailers to streamline the purchasing journey for customers and maximize their sales potential.

Until now, our services have primarily been used for e-commerce purposes– and will continue to excel in that area. However, the demand for buy now, pay later in stores has become all the more prevalent. Many retailers now recognize the clear value of offering competitive financing directly at checkout.

Modern financing gateways and digital tools such as WeGetFinancing + Sensepass have replaced the old paper-based, single-lender processes—delivering faster applications and a broader set of options. Today’s retail environments in sectors like home furniture, DIY, appliances, electronics, and especially PC Financing are seeing massive upside. In particular, PC Gaming Financing is gaining traction, as Gen Z and Millennials lead both BNPL adoption and gaming engagement in the U.S.—making this segment increasingly attractive for forward-thinking retailers..

The Demand for BNPL In-Store

“… Customers have begun to expect a certain level of flexibility when it comes to payment preferences. Not meeting these expectations should be regarded as a serious gap in the market as in-store shopping accounts for 85% of all US retail transactions“

While payment flexibility has made a name for itself in e-commerce, these options tend to be few and far between in physical retail settings. Those that are available tend to be either pay-in-four plans, like Klarna, or BNPL providers that cannot accommodate high-tickets– both of which are not optimal for larger purchases. The issue with this is that customers have begun to expect a certain level of flexibility when it comes to payment preferences. Not meeting these expectations should be regarded as a serious gap in the market as in-store shopping accounts for 85% of all US retail transactions (1).

Recognizing this growing demand, WeGetFinancing is expanding its operations through a collaboration with SensePass to lean into this untapped potential- now offering buy now, pay later services in stores.

SensePass to Bridge the Gap Between Online and In-Store Payment Flexibility

SensePass is a master of digital wallet technology. Their platform provides in-store merchants with access to a digital payment hub, with over 100 available options- far beyond traditional cash or credit cards. By seamlessly integrating with over 30 POS systems, including Oracle X, Store, NetSuite, NCR, Microsoft Dynamics 365, Aptos, and Shopify POS, SensePass simplifies the flexible process for merchants and customers alike.

SensePass X WeGetFinancing to Optimize BNPL In-Store

The collaboration between these two technologies marks a significant milestone in the availability of buy now, pay later services in stores.

SensePass merchants will now be able to provide:

- Large-ticket BNPL in-store accommodations, up to $15,000 with financing plans up to 60 months

- Full-credit spectrum financing through a large network of competitive lenders

- A frictionless checkout funnel delivering instant credit in milliseconds

- Boosts in ticket-sizes

WeGetFinancing’s BNPL in-store will give customers:

- Convenient, tap-to-pay financing from their own device

- The purchasing power for high-ticket items, no matter their credit score

- A suite of willing lenders with an appetite for their specific profile

For more information on the recent partnership between WeGetFinancing and SensePass, visit our press release.

You may also download some additional press material here : WegetFinancing-SensePass-Operation.pdf

Notes

(1) Quarterly Retail E-Commerce Sales (QUARTERLY RETAIL E-COMMERCE SALES 1st QUARTER 2024, 2024)1st Quarter 2024. U.S. Census Bureau. May, 2024. https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf